Exness, IronFX, FXTM, BDSwiss, and RoboMarkets—what do they have in common? All of them built their brand dominance by serving retail European clients. Yet, none of them currently offer services to retail clients on the continent. And they are only few of them names.

Retail to Professional Only

For years, the markets in the United Kingdom and Europe have been a top target for retail brokers. The high-income levels in these regions made it too profitable to ignore retail traders. However, broker strategies in Europe are now being questioned, as many top brands have either exited the region or stopped offering services to retail clients altogether.

Sophie Gerber, Co-CEO of TRAction and Director of Sophie Grace

“Brokers who have authorisation to accept retail clients in major jurisdictions, e.g. Cyprus, UK, EU, Singapore, Australia, USA, face considerable pressure from those regulators when seeking to do so,” said Sophie Gerber, Co-CEO of TRAction and Director of Sophie Grace Compliance.

“Maintaining a licence now requires compliance with a huge suite of different regimes,” Gerber added. “The most difficult of these has been the requirements for client suitability testing, treating customers fairly, and product intervention.”

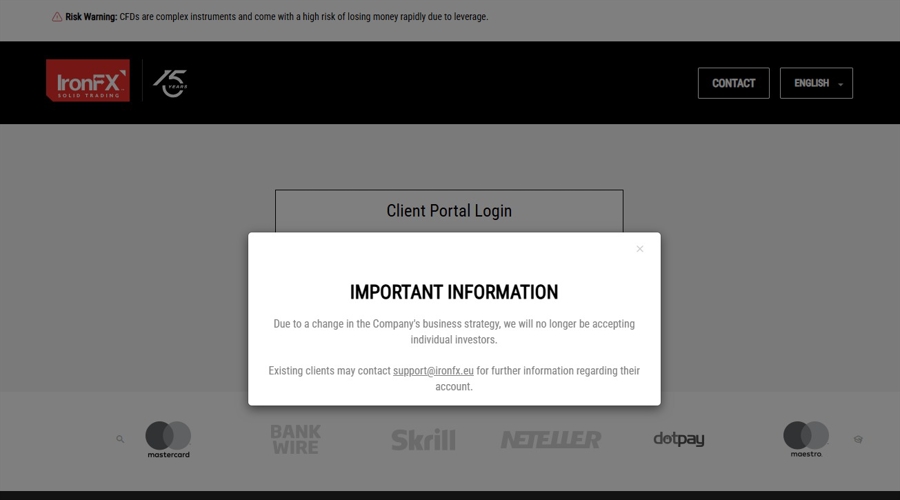

Exness and IronFX now provide services only to institutions under their European licences, shifting their retail focus to emerging markets. RoboMarkets, which still operates its legacy brand RoboForex, has repositioned its Cyprus-regulated entity as an institutional broker, while offering non-CFD products through a German entity.

BDSwiss, however, had a different story. After exiting the European retail market, the regulator suspended and then withdrew its Cyprus licence. As a result, the broker no longer maintains a presence in Europe.

FXTM is another big broker that stopped onboarding retail clients in 2021 across Europe due to the changed regulatory environment on the continent. Although the broker gave up its Cyprus licence entirely last year, it still onboards only professional clients in the UK.

You may also like: XM Owner Is Buying Controlling Stake in a Cyprus Bank

Incorrect Classification of Clients

Another issue gaining attention is the mischaracterisation of clients.

Remonda Kirketerp-Møller, Founder and CEO at Muinmos

As Remonda Kirketerp-Møller, Founder and CEO at Muinmos, pointed out, “CySEC (Cyprus Securities and Exchange Commission) has been having issues with many of its authorised investment firms, who have been onboarding clients without due regard to the regulatory framework, especially in terms of classifying their clients incorrectly.”

The Cypriot regulator has taken action against several brands for these practices. Earlier this year, it settled with Colmex Pro for €200,000 over similar alleged violations.

“It seems highly likely that CySEC has prevented many firms in Cyprus from onboarding retail clients to ensure that it complies with ESMA’s recommendations. It therefore appears that many brokers in Cyprus have chosen to stop onboarding retail clients in the island and instead onboard them from other entities, mainly offshore.”

European Clients Under Offshore Entities

The problem doesn’t stop with client classification. Many firms have continued onboarding European clients via offshore entities.

Tajinder Virk, co-founder and CEO at Finvasia Group

“Let’s be honest—a lot of brokers haven’t stopped onboarding EU or UK retail clients; they’ve just moved them offshore through affiliate URLs,” said Tajinder Virk, Co-Founder and CEO at Finvasia Group. “It’s a legal grey zone that regulators struggle to enforce.”

According to Virk, this shift began in 2018 after ESMA’s clampdown made it financially unviable to serve retail clients under local licences. Leverage restrictions further pushed traders toward offshore alternatives.

The CySEC also fined the local entity of IC Markets for onboarding clients via an offshore entity and offering leverage up to 1000:1—far above the EU cap of 30:1. IC Markets, however, denied the regulatory claims.

“The real loser here is the retail trader—less protection, less transparency,” Virk added. “Also, this is making Europe lose as well—the EU is losing tax revenue and pushing innovation out.”

For many brokers, the decision to scale back retail operations in regulated regions appears to be based purely on cost-benefit logic.

“When balanced with the costs and benefits of issuing the product ‘offshore’, it can present as an easy decision for groups to just shut down their retail offering in major jurisdictions,” Gerber added.

The Brexit Hit

The shift to professional-only onboarding is also visible in the UK.

ZFX, for example, only onboards professionals under its FCA licence while serving retail traders through its offshore setup. ICM.com, another well-known brand, has applied to cancel its UK licence.

David Barrett, CEO of the UK unit of EBC—which also limits UK operations to professional clients while using offshore licences for retail—believes both regulation and market economics are driving the change.

David Barrett, CEO of the UK unit of EBC Financial Group

“For many firms that had proudly worn the FCA badge, this caused a problem—the potential client base open to their attention was massively restricted,” Barrett said, pointing to the market reach after Brexit. “The EEA has about 450 million citizens, and the UK has about 70 million; clearly, the available audience is significantly smaller if you are based in the UK. The very large retail-focused platforms have saturated the market, leaving little fresh opportunity to small firms looking to build.”

Kirketerp-Møller also pointed to the complexities Brexit introduced for onboarding UK clients by EU investment firms and vice versa.

“This relates to reverse-solicitation, and there is huge complexity around this topic due to the lack of harmonisation even at a European level,” she explained. “Many investment firms are of the opinion that if they onboard ‘professional’ clients, this avoids the need for those firms to be licensed in the jurisdiction where their clients are coming from. This is a misconception.”

Interestingly, none of the 100 EU-based CFD brokers that opted for temporary permission after Brexit sought permanent authorisation from the FCA.

The UK and Europe Still Remain Lucrative

Despite the pullback from retail, the region continues to be financially attractive.

When eToro went public, it revealed that 70 per cent of its funded accounts came from the UK and Europe. The broker collected $931 million in total trading commission last year.

The dominance of publicly listed brokers such as IG Group, Plus500, CMC Markets, and XTB in the region is also clear. IG generated £146.8 million of its H1 FY25 revenue from the UK and Ireland, and a further £67.6 million from Europe.

You may also like: IG Group “Performed Strongly” in April as Trading Activity Jumped due to Volatility

“As more firms look to the EEA client base, the opportunities get harder,” Barrett added. “The big firms are getting larger; they are using their balance sheets to extend their offerings beyond the simple CFD model and building themselves into one-stop shops for not only financial trading but also investing and money management. Creating new brand recognition in a saturated market is difficult and expensive.”

“Retail is most productive on a large scale – this means large balance sheets, large staffing, huge fintech investment, and the never-ending requirement to grow the product base.”

Exness, IronFX, FXTM, BDSwiss, and RoboMarkets—what do they have in common? All of them built their brand dominance by serving retail European clients. Yet, none of them currently offer services to retail clients on the continent. And they are only few of them names.

Retail to Professional Only

For years, the markets in the United Kingdom and Europe have been a top target for retail brokers. The high-income levels in these regions made it too profitable to ignore retail traders. However, broker strategies in Europe are now being questioned, as many top brands have either exited the region or stopped offering services to retail clients altogether.

Sophie Gerber, Co-CEO of TRAction and Director of Sophie Grace

“Brokers who have authorisation to accept retail clients in major jurisdictions, e.g. Cyprus, UK, EU, Singapore, Australia, USA, face considerable pressure from those regulators when seeking to do so,” said Sophie Gerber, Co-CEO of TRAction and Director of Sophie Grace Compliance.

“Maintaining a licence now requires compliance with a huge suite of different regimes,” Gerber added. “The most difficult of these has been the requirements for client suitability testing, treating customers fairly, and product intervention.”

Exness and IronFX now provide services only to institutions under their European licences, shifting their retail focus to emerging markets. RoboMarkets, which still operates its legacy brand RoboForex, has repositioned its Cyprus-regulated entity as an institutional broker, while offering non-CFD products through a German entity.

BDSwiss, however, had a different story. After exiting the European retail market, the regulator suspended and then withdrew its Cyprus licence. As a result, the broker no longer maintains a presence in Europe.

FXTM is another big broker that stopped onboarding retail clients in 2021 across Europe due to the changed regulatory environment on the continent. Although the broker gave up its Cyprus licence entirely last year, it still onboards only professional clients in the UK.

You may also like: XM Owner Is Buying Controlling Stake in a Cyprus Bank

Incorrect Classification of Clients

Another issue gaining attention is the mischaracterisation of clients.

Remonda Kirketerp-Møller, Founder and CEO at Muinmos

As Remonda Kirketerp-Møller, Founder and CEO at Muinmos, pointed out, “CySEC (Cyprus Securities and Exchange Commission) has been having issues with many of its authorised investment firms, who have been onboarding clients without due regard to the regulatory framework, especially in terms of classifying their clients incorrectly.”

The Cypriot regulator has taken action against several brands for these practices. Earlier this year, it settled with Colmex Pro for €200,000 over similar alleged violations.

“It seems highly likely that CySEC has prevented many firms in Cyprus from onboarding retail clients to ensure that it complies with ESMA’s recommendations. It therefore appears that many brokers in Cyprus have chosen to stop onboarding retail clients in the island and instead onboard them from other entities, mainly offshore.”

European Clients Under Offshore Entities

The problem doesn’t stop with client classification. Many firms have continued onboarding European clients via offshore entities.

Tajinder Virk, co-founder and CEO at Finvasia Group

“Let’s be honest—a lot of brokers haven’t stopped onboarding EU or UK retail clients; they’ve just moved them offshore through affiliate URLs,” said Tajinder Virk, Co-Founder and CEO at Finvasia Group. “It’s a legal grey zone that regulators struggle to enforce.”

According to Virk, this shift began in 2018 after ESMA’s clampdown made it financially unviable to serve retail clients under local licences. Leverage restrictions further pushed traders toward offshore alternatives.

The CySEC also fined the local entity of IC Markets for onboarding clients via an offshore entity and offering leverage up to 1000:1—far above the EU cap of 30:1. IC Markets, however, denied the regulatory claims.

“The real loser here is the retail trader—less protection, less transparency,” Virk added. “Also, this is making Europe lose as well—the EU is losing tax revenue and pushing innovation out.”

For many brokers, the decision to scale back retail operations in regulated regions appears to be based purely on cost-benefit logic.

“When balanced with the costs and benefits of issuing the product ‘offshore’, it can present as an easy decision for groups to just shut down their retail offering in major jurisdictions,” Gerber added.

The Brexit Hit

The shift to professional-only onboarding is also visible in the UK.

ZFX, for example, only onboards professionals under its FCA licence while serving retail traders through its offshore setup. ICM.com, another well-known brand, has applied to cancel its UK licence.

David Barrett, CEO of the UK unit of EBC—which also limits UK operations to professional clients while using offshore licences for retail—believes both regulation and market economics are driving the change.

David Barrett, CEO of the UK unit of EBC Financial Group

“For many firms that had proudly worn the FCA badge, this caused a problem—the potential client base open to their attention was massively restricted,” Barrett said, pointing to the market reach after Brexit. “The EEA has about 450 million citizens, and the UK has about 70 million; clearly, the available audience is significantly smaller if you are based in the UK. The very large retail-focused platforms have saturated the market, leaving little fresh opportunity to small firms looking to build.”

Kirketerp-Møller also pointed to the complexities Brexit introduced for onboarding UK clients by EU investment firms and vice versa.

“This relates to reverse-solicitation, and there is huge complexity around this topic due to the lack of harmonisation even at a European level,” she explained. “Many investment firms are of the opinion that if they onboard ‘professional’ clients, this avoids the need for those firms to be licensed in the jurisdiction where their clients are coming from. This is a misconception.”

Interestingly, none of the 100 EU-based CFD brokers that opted for temporary permission after Brexit sought permanent authorisation from the FCA.

The UK and Europe Still Remain Lucrative

Despite the pullback from retail, the region continues to be financially attractive.

When eToro went public, it revealed that 70 per cent of its funded accounts came from the UK and Europe. The broker collected $931 million in total trading commission last year.

The dominance of publicly listed brokers such as IG Group, Plus500, CMC Markets, and XTB in the region is also clear. IG generated £146.8 million of its H1 FY25 revenue from the UK and Ireland, and a further £67.6 million from Europe.

You may also like: IG Group “Performed Strongly” in April as Trading Activity Jumped due to Volatility

“As more firms look to the EEA client base, the opportunities get harder,” Barrett added. “The big firms are getting larger; they are using their balance sheets to extend their offerings beyond the simple CFD model and building themselves into one-stop shops for not only financial trading but also investing and money management. Creating new brand recognition in a saturated market is difficult and expensive.”

“Retail is most productive on a large scale – this means large balance sheets, large staffing, huge fintech investment, and the never-ending requirement to grow the product base.”