Veteran trader Peter Brandt believes that risk assets such as the S&P 500, Bitcoin (BTC) and Ethereum (ETH) will see much lower levels by the end of the year.

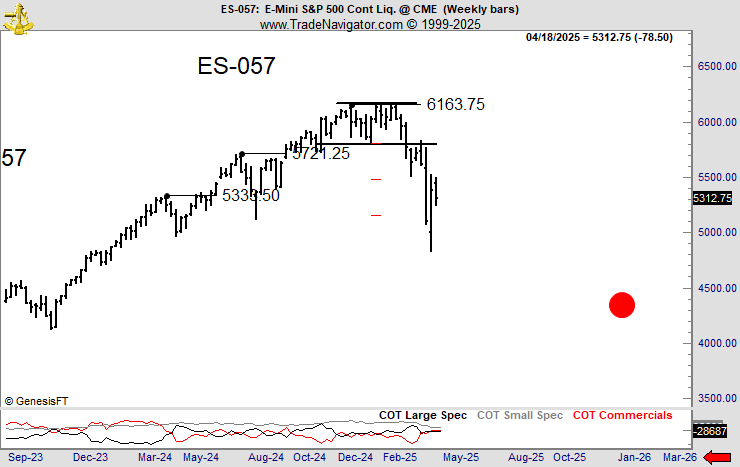

Starting with the US stock market, Brandt tells his 792,500 followers on the social media platform X that the S&P 500 looks bearish after breaching support at 5,800 and retesting the level as resistance.

Brandt predicts that the S&P 500 will close the year slightly below 4,500 points.

“The Red Dots are where I think we end the year in 2025.”

As of Friday’s close, the S&P 500 is trading at 5,282.

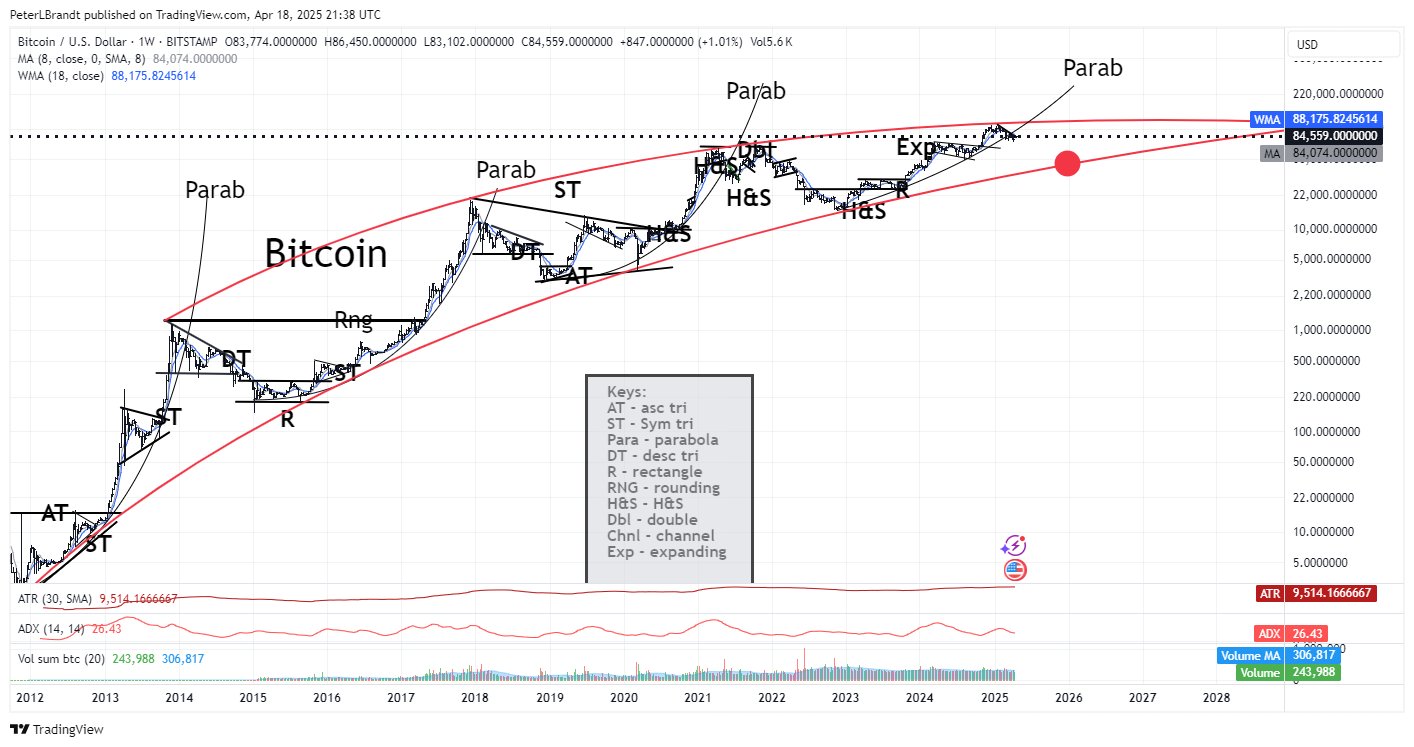

Looking at Bitcoin, Brandt sees BTC dropping to around the $50,000 price zone after violating a parabola that has kept Bitcoin bullish since 2023.

“Not my opinion, but it is what the chart suggests as possible.”

At time of writing, Bitcoin is trading for $85,280.

Turning to Ethereum, Brandt predicts that ETH will plummet to around $600 by the end of the year.

“ETHUSD”

At time of writing, ETH is worth $1,616.

As for gold, the trader thinks that the precious metal has more room to run to the upside this year. He shares a chart suggesting that gold has broken out of an ascending channel pattern and could hit prices close to $3,600.

An ascending channel indicates that an asset is in an uptrend as it prints higher highs and higher lows. A channel breakout suggests that an asset is in the midst of a strong bull market.

“Gold Finger, the market with the magic touch.”

Gold is worth $3,327 as of Friday’s close.

Follow us on X, Facebook and Telegram

Don’t Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any losses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Generated Image: DALLE3