The biggest bank in the US has begun blocking certain transactions from Zelle after hundreds of millions of dollars in scams were reportedly facilitated through the payments platform.

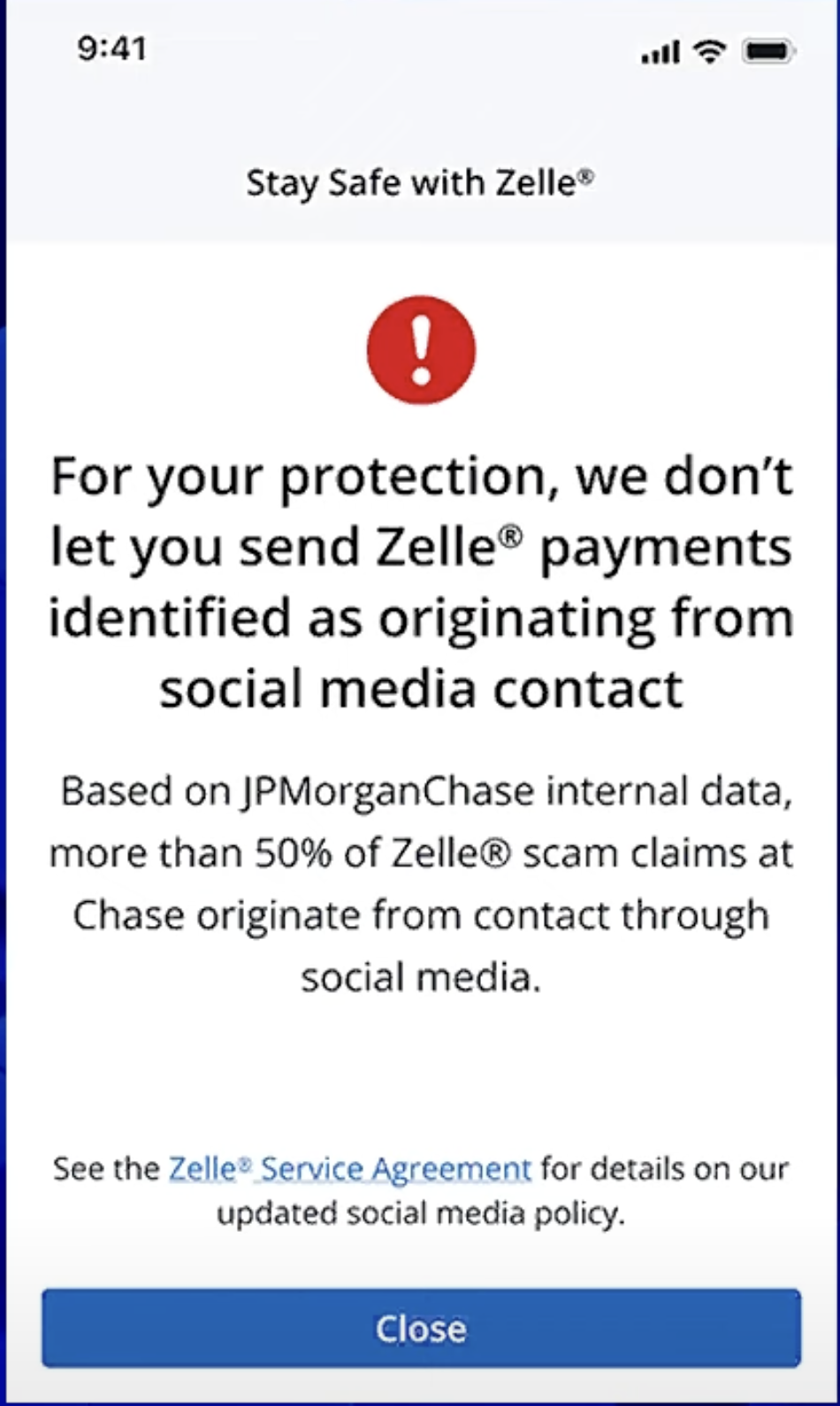

US banking giant JPMorgan Chase is now giving pop-ups to Zelle users who try to send money to people who appear to originate from social media, CNBC reports.

The bank warns that over half of all the Zelle scams are initiated through social media platforms.

Melissa Feldsher, JPMorgan’s head of payments and lending innovation, says that the bank doesn’t recommend using apps like Zelle for sending payments to people you aren’t familiar with.

“Many of the interactions that are happening over social media are between people that don’t know each other, and as a result, you are having interactions [that are] leading to money exchange between people that don’t know each other.

We think in instances that you are transacting and sending money to someone you don’t know, you should be using a product that has purchase protection, products that we offer at Chase, like debit cards and credit cards. We don’t think you should be using products like Zelle – the same way you wouldn’t use cash to send money to buy something from someone you’ve never met or goods you have never seen.”

A recent Senate report from last July found that $207 million worth of Zelle payments were disputed as scams from customers at JPMorgan Chase, Bank of America and Wells Fargo – the vast majority of which went unreimbursed.

Follow us on X, Facebook and Telegram

Don’t Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Surf The Daily Hodl Mix