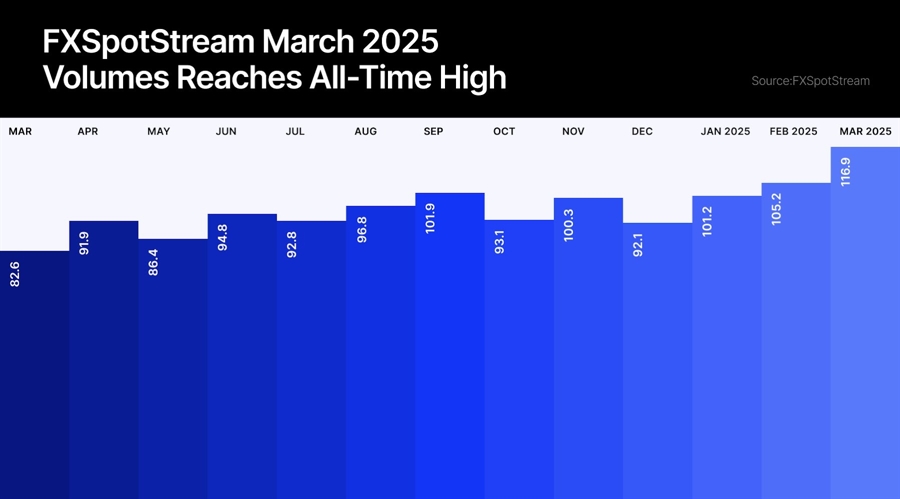

Since the

beginning of 2025, we’ve been observing above-average volatility in financial

markets, including foreign exchange (FX). This is confirmed by another

consecutive record-breaking month for FXSpotStream.

The

multibank FX aggregation services provider achieved a total average daily

volume (ADV) of $116.9 billion in March 2025, climbing to the highest values in

its history.

FXSpotStream Volume

Reaches Historic Highs (Again)

According

to FXSpotStream’s data, March volumes proved stronger than the record-breaking

February, when ADV was $105.2 billion. January was also strong with a result of

$101.2 billion, nearly matching the previous all-time high that was tested in

September 2024.

The scale

of the current month-to-month growth is also impressive, reaching 13.7% and

increasing ADV by an average of $14.4 billion daily.

Both spot

trading reached record highs, growing from $75.1 billion to $83.1 billion, and

the “other ADV” category increased from $30 billion in February to

$34 billion in March.

When comparing

these results with those from a year ago, the growth becomes even more

impressive, amounting to nearly 45%.

FX Venues Confirm Strong

March

FXSpotStream

is not the only major institutional FX trading operator that recorded a

significant jump in volumes last month. As reported by FinanceMagnates.com, other

popular platforms also experienced a strong increase, taking advantage of,

among other things, the enormous volatility in the weakening dollar.

Click 365,

the currency trading platform on the Tokyo Financial Exchange (TFX), reported

an ADV growth of 23%, while in the USA, Cboe FX achieved daily volumes of $52.1

billion, 8% higher compared to February.

Euronext

FX’s Fastmatch and German stock-exchange owned 360T also followed this trend.

ANZ Bank Becomes 17th

Liquidity Provider on FXSpotStream

In the

meantime, Australia’s ANZ Bank has established a new partnership with

FXSpotStream, enhancing its FX liquidity offerings. This strategic move

positions ANZ as the newest addition to FXSpotStream’s impressive roster of

global liquidity providers, which now totals 17 financial institutions

including major players like Bank of America, JPMorgan, and Barclays.

In related

news, FXSpotStream’s European division has posted impressive financial results

for its EMEA operations. According to recent documentation filed with the UK’s

Companies House, FXSpotStream Europe Ltd achieved substantial growth in

turnover, reaching $3.5 million—representing a robust 40% increase from the

$2.5 million recorded in the previous financial period.

This article was written by Damian Chmiel at www.financemagnates.com.

Source link