US retail Forex

brokers reported mixed customer deposits in March 2025, with the sector showing

modest overall growth despite significant market volatility and continued

weakness in the US dollar, according to regulatory data provided by the Commodity

Futures Trading Commission (CFTC).

Charles Schwab Leads

Growth in US Forex Market

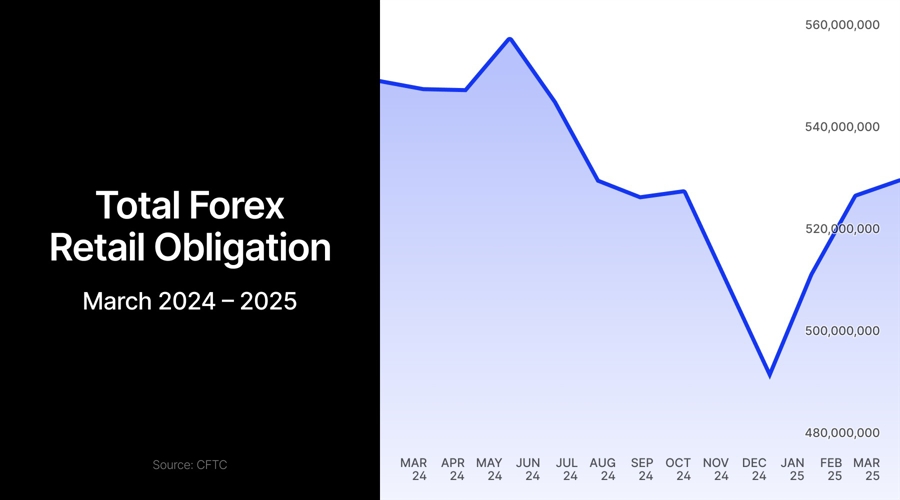

Total

customer deposits at major US Forex brokers increased to $530.1 million in

March, up 0.6% from February’s $527.0 million. However, the figure represents a

3.6% decline compared to March 2024, when deposits stood at $549.4 million.

Charles

Schwab led the growth among major brokers, with customer Forex deposits rising

3.6% month-over-month to $63.2 million. Gain Capital, the largest player in the

US retail forex market, saw deposits increase by 0.7% to $226.6 million.

Interactive

Brokers reported the strongest percentage growth, with Forex deposits

increasing 10.8% to $32.1 million from February’s $28.6 million. Trading.com

also saw a slight increase of 1.1% to $2.5 million.

However,

not all brokers benefited from the volatile market conditions. IG US

experienced a 5.7% decline in deposits to $44.2 million, while Oanda saw

deposits fall by 1.1% to $161.4 million.

Dollar Weakness Drives

Market Volatility

The changes

in retail forex deposits occurred against a backdrop of significant dollar

weakness. The US Dollar Index (DXY), which measures the greenback against a

basket of major currencies, hit a three-year low in March 2025, declining more

than 3% during the period.

Market

volatility spiked dramatically during the month, with short-dated volatility

nearly doubling at its peak compared to month-end levels, according to data

from Cboe.

The

dollar’s decline accelerated amid growing investor concerns about US trade

policies, economic growth outlook, and potential threats to Federal Reserve

independence. By mid-May, the DXY had recovered slightly to 101.19, but

remained significantly lower than its levels earlier in the year.

Year-over-Year Declines

Despite the

monthly increase, the longer-term trend shows declining retail Forex

participation in the US market. Compared to March 2024, total customer deposits

were down 3.6%.

The most

significant year-over-year decline came from IG US, which saw a 37.2% drop in

deposits. Oanda also experienced a substantial 14.0% decrease compared to the

previous year.

Only two

brokers reported year-over-year growth: Gain Capital, with an 8.0% increase,

and Trading.com, with a 30.7% rise, though the latter operates from a much

smaller base.

Analysts

attribute the overall year-over-year decline to a combination of factors,

including regulatory changes, increased competition from cryptocurrency trading

platforms, and shifting retail investor preferences.

Regulatory Compliance

To ensure

the protection of client funds, the CFTC mandates that all licensed forex

brokers hold significant capital reserves. Recent regulatory disclosures

confirm that all six reviewed firms are currently in compliance with, or

surpass, the commission’s minimum capital standards.

The figures

are based on monthly financial statements submitted to the CFTC by registered

futures commission merchants (FCMs) and retail forex dealers.

This article was written by Damian Chmiel at www.financemagnates.com.

Source link