Crypto exchanges aren’t coming for the FX and contracts for differences (CFDs) CFDs brokers—they’re already here. And they’re not dipping their toes into traditional finance—they’re coming for it all.

With regulation, tech, capital, and global user bases behind them, they’re building the future while most FX and CFD brokers are still clinging to the past.

The Intentions of Crypto Exchanges — And Why They’ll Win

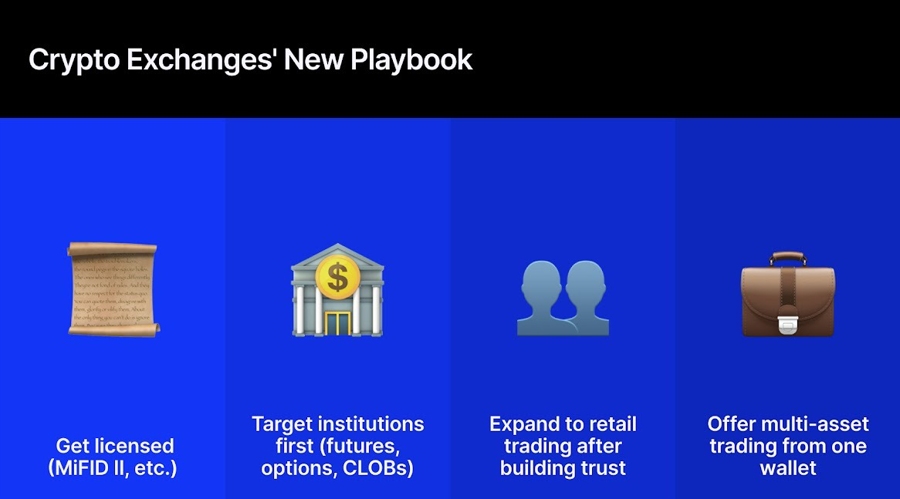

Crypto exchanges are no longer satisfied with offering just crypto. Their playbook is becoming crystal clear:

•Acquire regulatory licenses (MiFID II, etc.) to enter the TradFi framework

•Start with institutions—futures, options, and CLOBs—where they already have a structural edge

•Expand into retail once trust and regulatory coverage are secured

•Offer multi-asset trading (crypto, FX, equities, commodities) from one unified wallet

Coinbase, Kraken, and OKX have already secured MiFID II licenses to cooperate in the European Economic Area. Kraken also acquired NinjaTrader, a regulated US futures broker, and even recently launched FX perpetual contracts.

They’re regulated, capitalised, tech-native, and serving tens of millions of users globally. When they arrive at full scale in TradFi, most traditional brokers won’t be able to compete. Because these crypto exchanges understand tech, UX, branding, and community in ways most brokers simply don’t. They move faster, scale faster, and build better. And they’re playing a different game entirely.

🚨 Introducing FX Perpetual Futures!

Giving you 24/7 access to $EUR & $GBP perps alongside your favorite crypto markets.

No expiries, no barriers, just unstoppable opportunities 🌍

Trade now 👉 https://t.co/uRl6PG9EeU

*Geo restrictions apply pic.twitter.com/lJFR190c1e

— Kraken Pro (@krakenpro) April 18, 2025

FX & CFD Brokers: Three Types, Three Fates

Based on the traits, legacy FX and CFDs brokers can be categorised into three types: the deniers, the opportunists, and “eToro”.

Type 1: The Deniers

These brokers still view crypto as a secondary or “too risky” product. They’re wrong.

As user behaviour shifts toward 24/7, mobile-first, high-frequency trading, ignoring crypto means bleeding relevance. Worse, many in TradFi still believe that their experience gives them automatic legitimacy.

Meanwhile, crypto-native platforms are onboarding millions and outpacing them financially. Credibility today doesn’t come from your résumé. It comes from your user base. And the biggest thing standing in the way of TradFi adapting? Ego.

After 17+ years in FX and CFDs, and speaking to brokers daily, one thing is clear: most have no real understanding of what a Web3 ecosystem or user experience looks like. The crypto world plays by entirely different rules—from how products are built to how growth is driven.

But to truly understand it, you have to learn from the people building it—and that’s where the friction starts. It means listening to 23-year-olds who live in Discord, run DAOs, and launch six-figure meme-driven marketing campaigns before finishing university.

For many TradFi executives, those people look like a joke—green hair, hoodies, maybe younger than their own kids. And that’s the problem – not tech, regulation, or strategy. Ego is the real obstacle. And it’s the reason most will fall behind.

Type 2: The Opportunists

These brokers see crypto as a growth hack—cheap payment rails, fast onboarding, and a way to reach markets previously blocked by monetary controls. They’re half right.

Crypto can be a powerful acquisition engine and a bridge into the Web3-native world.

But Web3 users don’t want a traditional broker with a “crypto tab.” They want a real crypto experience—an ecosystem with transparency, ownership, and community. Tacking crypto onto a legacy platform without adopting Web3 values and UX won’t cut it.

To win over this generation, you have to build for them, not sell to them.

Type 3: The (Only) Case

There’s only one real standout here: eToro. They made the leap early—not by offering crypto as a feature, but by embedding it into the core of their platform. And it paid off.

In 2024, eToro reported:

•$931 million in total commissions

•38% of that—around $354 million—from crypto alone

•A net profit of $192 million, up from just $15.3 million the year before

No other traditional broker has successfully made that leap.

The MetaQuotes Bottleneck

The FX and CFD space has become a sea of sameness. 99% of brokers still rely on MetaQuotes (MT4/MT5)—delivering nearly identical products, pricing, and UX. This overdependence has created an overcrowded market with minimal differentiation and cutthroat pricing wars.

Worse yet, MetaQuotes is fundamentally unfit for crypto. MetaTrader platforms do not support wallet integration, and they have neither blockchain connectivity nor Web3 compatibility.

For MetaQuotes-dependent brokers, pivoting to crypto isn’t a tweak—it’s a full rebuild.

And in a market that rewards speed and agility, that’s a steep hill to climb.

You may also like: Brokers Are Leaving MetaTrader Behind When Integrating TradingView: Here’s Why

The Lesson?

Crypto is no longer just a product. It’s the infrastructure. It’s the distribution. It’s the future of finance. And the window for FX and CFD brokers to catch up is closing—fast.

Because once crypto exchanges fully set their sights on TradFi mass retail, 80% of brokers in this space won’t survive.

If they want to survive, they must:

1.Launch and integrate crypto offerings.

2.Build the full crypto ecosystem.

3.Kill the ego—learn from the new generation, not the old guard.

My previous experiences in the professional world taught me not to make the mistake of thinking that coming from TradFi made me “legit,” but it doesn’t. In Web3, that background might even work against you. Because it’s not TradFi entering crypto—it’s crypto taking over finance. And if you’re not awake to that shift, you won’t just fall behind—you’ll be eaten alive.

Crypto exchanges aren’t coming for the FX and contracts for differences (CFDs) CFDs brokers—they’re already here. And they’re not dipping their toes into traditional finance—they’re coming for it all.

With regulation, tech, capital, and global user bases behind them, they’re building the future while most FX and CFD brokers are still clinging to the past.

The Intentions of Crypto Exchanges — And Why They’ll Win

Crypto exchanges are no longer satisfied with offering just crypto. Their playbook is becoming crystal clear:

•Acquire regulatory licenses (MiFID II, etc.) to enter the TradFi framework

•Start with institutions—futures, options, and CLOBs—where they already have a structural edge

•Expand into retail once trust and regulatory coverage are secured

•Offer multi-asset trading (crypto, FX, equities, commodities) from one unified wallet

Coinbase, Kraken, and OKX have already secured MiFID II licenses to cooperate in the European Economic Area. Kraken also acquired NinjaTrader, a regulated US futures broker, and even recently launched FX perpetual contracts.

They’re regulated, capitalised, tech-native, and serving tens of millions of users globally. When they arrive at full scale in TradFi, most traditional brokers won’t be able to compete. Because these crypto exchanges understand tech, UX, branding, and community in ways most brokers simply don’t. They move faster, scale faster, and build better. And they’re playing a different game entirely.

🚨 Introducing FX Perpetual Futures!

Giving you 24/7 access to $EUR & $GBP perps alongside your favorite crypto markets.

No expiries, no barriers, just unstoppable opportunities 🌍

Trade now 👉 https://t.co/uRl6PG9EeU

*Geo restrictions apply pic.twitter.com/lJFR190c1e

— Kraken Pro (@krakenpro) April 18, 2025

FX & CFD Brokers: Three Types, Three Fates

Based on the traits, legacy FX and CFDs brokers can be categorised into three types: the deniers, the opportunists, and “eToro”.

Type 1: The Deniers

These brokers still view crypto as a secondary or “too risky” product. They’re wrong.

As user behaviour shifts toward 24/7, mobile-first, high-frequency trading, ignoring crypto means bleeding relevance. Worse, many in TradFi still believe that their experience gives them automatic legitimacy.

Meanwhile, crypto-native platforms are onboarding millions and outpacing them financially. Credibility today doesn’t come from your résumé. It comes from your user base. And the biggest thing standing in the way of TradFi adapting? Ego.

After 17+ years in FX and CFDs, and speaking to brokers daily, one thing is clear: most have no real understanding of what a Web3 ecosystem or user experience looks like. The crypto world plays by entirely different rules—from how products are built to how growth is driven.

But to truly understand it, you have to learn from the people building it—and that’s where the friction starts. It means listening to 23-year-olds who live in Discord, run DAOs, and launch six-figure meme-driven marketing campaigns before finishing university.

For many TradFi executives, those people look like a joke—green hair, hoodies, maybe younger than their own kids. And that’s the problem – not tech, regulation, or strategy. Ego is the real obstacle. And it’s the reason most will fall behind.

Type 2: The Opportunists

These brokers see crypto as a growth hack—cheap payment rails, fast onboarding, and a way to reach markets previously blocked by monetary controls. They’re half right.

Crypto can be a powerful acquisition engine and a bridge into the Web3-native world.

But Web3 users don’t want a traditional broker with a “crypto tab.” They want a real crypto experience—an ecosystem with transparency, ownership, and community. Tacking crypto onto a legacy platform without adopting Web3 values and UX won’t cut it.

To win over this generation, you have to build for them, not sell to them.

Type 3: The (Only) Case

There’s only one real standout here: eToro. They made the leap early—not by offering crypto as a feature, but by embedding it into the core of their platform. And it paid off.

In 2024, eToro reported:

•$931 million in total commissions

•38% of that—around $354 million—from crypto alone

•A net profit of $192 million, up from just $15.3 million the year before

No other traditional broker has successfully made that leap.

The MetaQuotes Bottleneck

The FX and CFD space has become a sea of sameness. 99% of brokers still rely on MetaQuotes (MT4/MT5)—delivering nearly identical products, pricing, and UX. This overdependence has created an overcrowded market with minimal differentiation and cutthroat pricing wars.

Worse yet, MetaQuotes is fundamentally unfit for crypto. MetaTrader platforms do not support wallet integration, and they have neither blockchain connectivity nor Web3 compatibility.

For MetaQuotes-dependent brokers, pivoting to crypto isn’t a tweak—it’s a full rebuild.

And in a market that rewards speed and agility, that’s a steep hill to climb.

You may also like: Brokers Are Leaving MetaTrader Behind When Integrating TradingView: Here’s Why

The Lesson?

Crypto is no longer just a product. It’s the infrastructure. It’s the distribution. It’s the future of finance. And the window for FX and CFD brokers to catch up is closing—fast.

Because once crypto exchanges fully set their sights on TradFi mass retail, 80% of brokers in this space won’t survive.

If they want to survive, they must:

1.Launch and integrate crypto offerings.

2.Build the full crypto ecosystem.

3.Kill the ego—learn from the new generation, not the old guard.

My previous experiences in the professional world taught me not to make the mistake of thinking that coming from TradFi made me “legit,” but it doesn’t. In Web3, that background might even work against you. Because it’s not TradFi entering crypto—it’s crypto taking over finance. And if you’re not awake to that shift, you won’t just fall behind—you’ll be eaten alive.