Binance founder Changpeng Zhao has recommended that Kyrgyzstan consider Bitcoin and BNB as the first assets in building its National Crypto Reserve.

His May 5 suggestion followed an invitation to join the country’s National Crypto Council, marking a notable step in the nation’s engagement with digital assets.

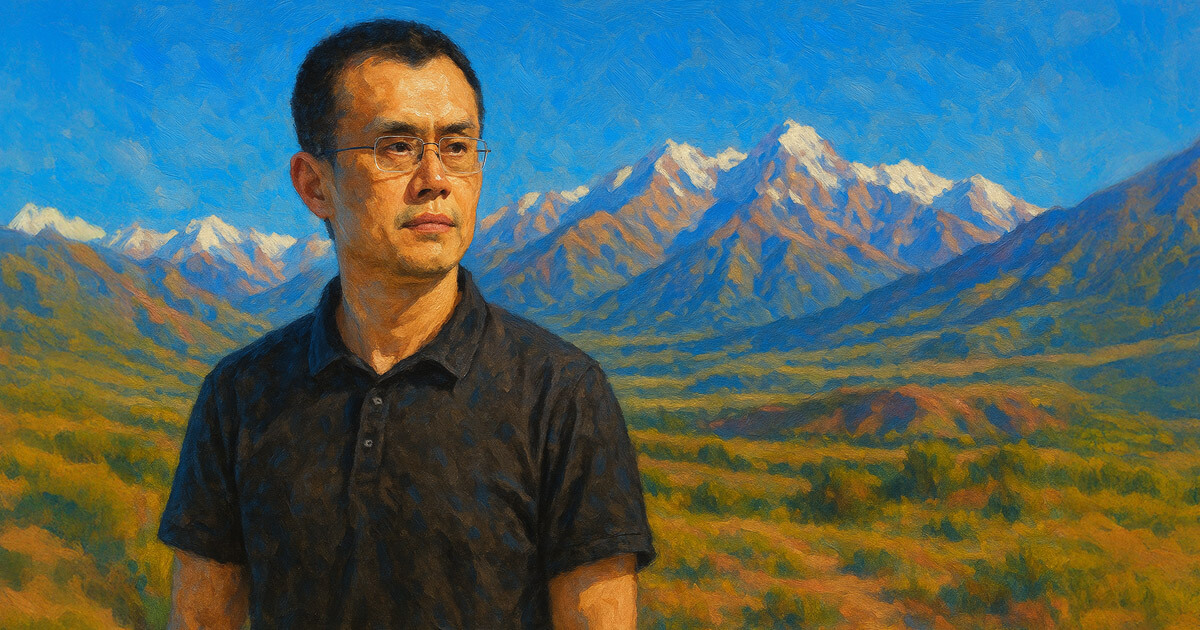

Zhao visited Kyrgyzstan at the invitation of President Sadyr Japarov. The two held discussions over two days by Lake Issyk-Kul, where they explored the potential of blockchain technology in the country’s economic strategy.

President Japarov said:

“We presented Kyrgyzstan’s potential in developing a digital economy and demonstrated the richness of our culture and the uniqueness of our national identity through a specially prepared cultural program.”

A day before Zhao’s announcement, Kyrgyzstan’s National Investment Agency confirmed a new partnership with Binance.

The agreement aims to accelerate the adoption of crypto payments and promote digital finance education across the region.

One key outcome of the partnership will be the rollout of Binance Pay, which will enable crypto-based transactions across Central Asia and simplify cross-border remittances with neighboring countries in the Eurasian Economic Union.

Kyrgyzstan’s gold-backed stablecoin

In parallel development, Coindesk reported that Kyrgyzstan is preparing to launch its gold-backed stablecoin pegged to the US dollar.

The new token, USDKG, is scheduled for release in the third quarter of 2025. The asset would initially be backed by $500 million in gold from the Ministry of Finance. However, the reserve is expected to grow to as much as $2 billion.

USDKG will maintain a fixed 1:1 value with the US dollar, unlike gold-pegged tokens that track market prices. This means the gold reserves will serve as collateral, helping stabilize the token while ensuring liquidity.

Meanwhile, officials reportedly said USDKG will be overcollateralized to manage potential gold price fluctuations.

The token holders will be able to redeem it for physical gold, other cryptocurrencies, or fiat currency, making it suitable for cross-border transactions and long-term value storage