Uncertainty is driving gold’s price momentum, according to analysts at the capital markets newsletter The Kobeissi Letter.

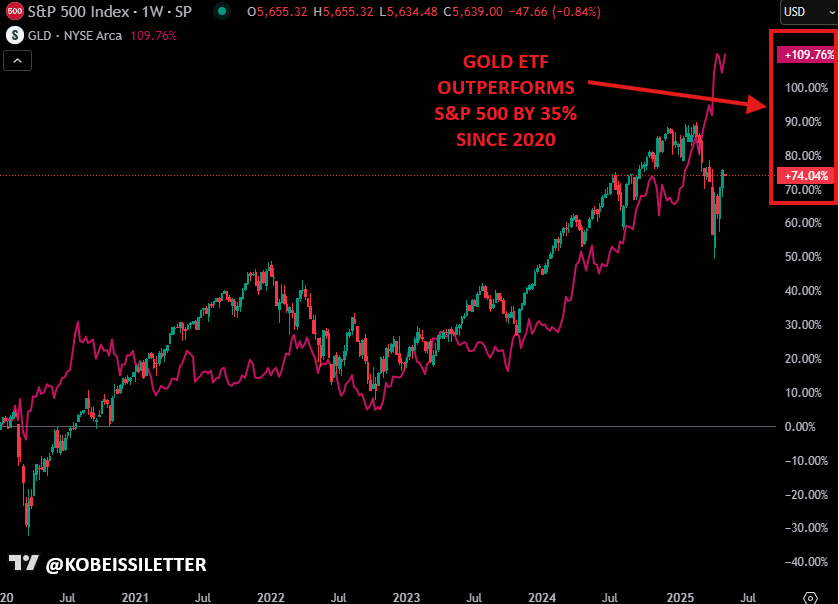

The Kobeissi Letter’s official account on the social media platform X notes that heading into this year, gold had been underperforming the S&P 500 by approximately 10% since 2020.

“However, as uncertainty has risen, GLD is now up +109% since 2020 compared to +74% in the S&P 500. But, why are gold prices surging even as the market recovers? Uncertainty remains the answer.”

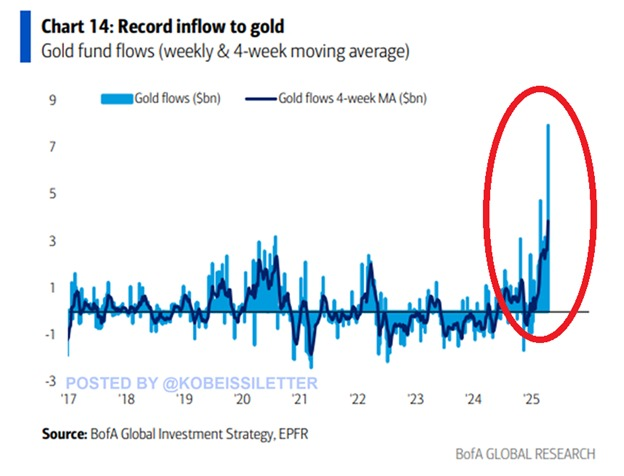

The analysts also note that gold funds witnessed approximately $8 billion in net inflows three weeks ago, a record-setting total they say suggests “a continued flight to safety.”

“As a result, the four-week moving average of inflows jumped to ~$4 billion, also an all-time high. This is likely the strongest gold market of all time.”

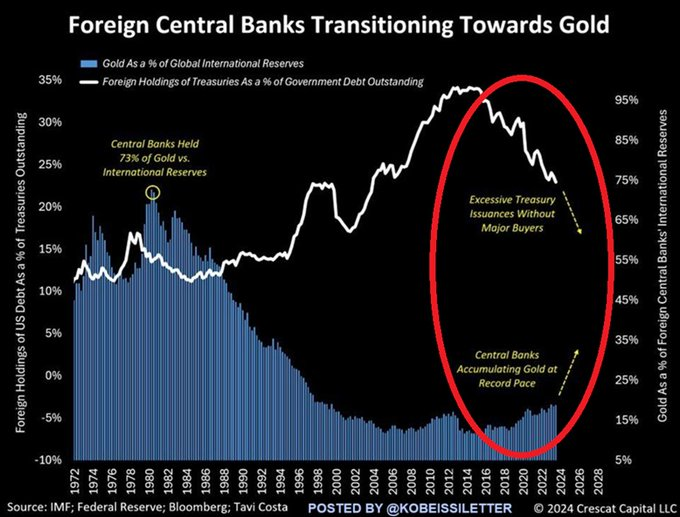

They also say central bank buying remains “historically strong.” The newsletter notes that foreign holdings of Treasuries as a percentage of US government debt have fallen to approximately 23%, the lowest in more than two decades.

The analysts, citing data from macro strategist Otavio Costa, also note that gold holdings as a percentage of global reserves have surged to approximately 18%, the highest in 26 years.

The Kobeissi Letter also points out that the US Dollar Index (DXY) recently plunged to a 52-week low. The DXY measures the strength of the USD against a basket of other major foreign currencies.

“The US Dollar, DXY, has weakened by nearly 10% since the trade war began. A weaker dollar makes USD-denominated gold cheaper for foreign investors. Gold is almost serving as a leading indictor for tariffs.”

Follow us on X, Facebook and Telegram

Don’t Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any losses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Generated Image: Midjourney