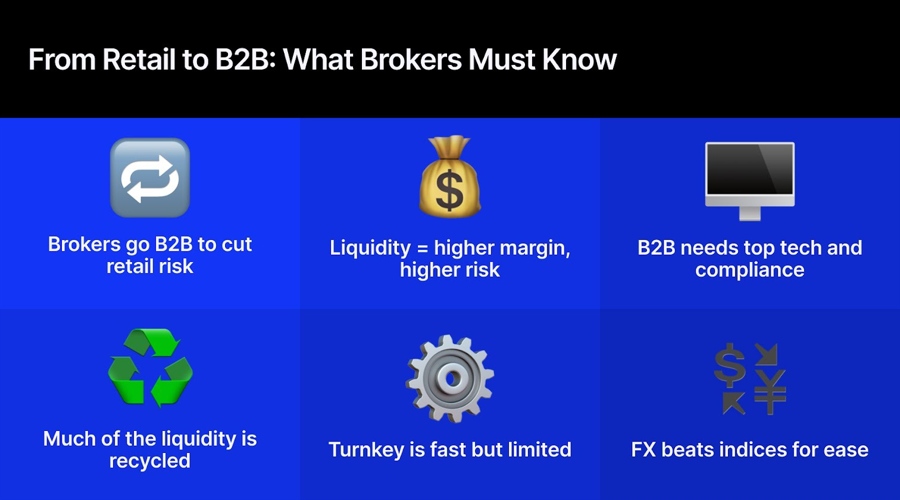

Moving into the B2B space is an opportunity for brokers to diversify revenue streams and reduce dependency on retail flows – but it’s no quick fix for those looking to bump up their margins.

Growing competition in retail trading coupled with rising customer expectations has made acting as a liquidity provider seem like a logical progression for many brokers.

A Natural Evolution for Brokers

Paul Jackson, head of sales at Finalto, describes it as a natural evolution for brokers with established internal infrastructure, while Pete Mulmat, CEO of tastyfx says it aligns with industry trends toward expanding asset classes and service offerings and benefits the existing business downstream by giving clients flexibility and competitive pricing as higher margins are retained in-house.

There is also a risk management element to this shift suggests Arthur Azizov, founder of liquidity provider turnkey solutions developer, B2 Ventures.

“Relying purely on retail flow is becoming less viable,” he says. “Expanding into B2B allows brokers to attract more sophisticated clients and gain greater control over pricing and execution. It’s all about building resilience in a market that is constantly shifting.”

However, new brokers often face significant challenges when trying to access liquidity from Tier 1 banks and prime brokers. These challenges include stringent credit requirements, high capital thresholds and the need for established relationships.

Michael Aagaard, Managing Director, GCEX

Additionally, the complex regulatory environment and the requirement for advanced technological infrastructure can be prohibitive for smaller firms.

“Regulatory challenges include compliance with stringent financial regulations, anti-money laundering laws and know-your-customer requirements,” explains Michael Aagaard, managing director GCEX. “Operationally, brokers must invest in robust risk management systems, advanced trading platforms and high speed connectivity to ensure efficient and reliable liquidity provision.”

You may also like: White Label, Big Bill? The Hidden Costs of Going Plug-and-Play in Prop Trading

Purveyors of Prime of Prime Recycled Liquidity

There are many firms promoting institutional FX liquidity when what they mean is that they are purveyors of prime of prime recycled liquidity – taking a bunch of other liquidity feeds and wrapping them up into a best bid offer model, sticking on a small amount of price widening and maybe a few dollars per million for the execution cost and hoping for the best suggests Richard Elston, head of institutional at CMC Markets.

Richard Elston, Group Head of Institutional at CMC Connect; Source: LinkedIn

“There is probably a market for that but it is likely to be to those much smaller brokers that operate in an offshore capacity,” he says. “If you’re operating in a tier one jurisdiction as a retail broker you will probably want to face a larger entity.”

In addition, as a prime of prime provider you are effectively a middleman and would have to put quite a bit of capital up for probably quite a small return per million traded, especially in the popular crosses.

When a broker shifts from serving end clients to serving other businesses, everything changes. B2B relationships often require different licensing structures (sometimes across multiple jurisdictions) and depending on the products and client types, this might involve dealing with additional capital requirements, reporting standards or even new categories of regulatory oversight.

“Operationally, expectations rise sharply,” acknowledges Azizov. “B2C operations can often afford minor inefficiencies or platform hiccups. In B2B, however, the tolerance for error is close to zero. Failures – either technical or procedural – can damage reputations quickly and irreversibly.”

Moreover, B2B service providers need to invest in specialised infrastructure and personnel. So it is not just about offering trading platforms but ensuring deep liquidity, reliable pricing, fast execution and flexible integrations.

According to Azizov, many brokers underestimate the complexity of this transition. What worked for retail doesn’t automatically scale to institutional and those who don’t plan for that often find themselves overwhelmed by the operational demands.

Arthur Azizov, Founder and CEO of B2Broker, Source: LinkedIn

Brokers may be required to upgrade or acquire new licences when transitioning from a brokerage model to liquidity provider and capital requirements are generally higher when acting as a market maker and taking on principal risk agrees Jackson.

“Liquidity providers must also abide by stringent market conduct rules, in terms of best execution and pre- and post-trade reporting,” he says. “From an operational standpoint, a liquidity provider’s technical infrastructure must be fast and robust, with ongoing investment backed up by superior risk surveillance and support.”

Read more: Beyond Exotic Pairs – Brokers Focus More on Enhancing Services in Low Volatile Market

Bilateral Conversations Between Maker and Taker Are Most Successful

Elston says the most successful relationships he has from a liquidity provider perspective are those where there are bilateral conversations between maker and taker.

“There are several kinds of taker out there,” he adds. “If they are effectively little more than marketing vehicles looking to grab as many clients as they can, it becomes really hard to have that sophisticated conversation. You need to be dealing with a trading desk that has a really good understanding of the underlying flow.”

There are many genuine liquidity providers in FX, but many brokers would struggle to get a seat at the table of the top tier – which is why there is a place for redistribution of FX liquidity through prime of prime brokers.

The challenges outlined above have driven the emergence of turnkey liquidity provider infrastructure solutions.

Pete Mulmat, CEO of tastyfx

“This approach gives brokers a proven, ready-to-launch system while still allowing for strategic adjustments to fit their specific business needs, balancing the efficiency of turnkey solutions with enough flexibility to make it their own,” says Mulmat.

Jackson observes that these ready-made platforms provide instant access to deep, multi-asset liquidity, built-in risk management, regulatory compliance tools and ongoing technical support, eliminating the need for extensive in-house development.

Paul Jackson, Head of Sales at Finalto

“With lower upfront costs, faster time to market and scalable, white label-ready options, they allow businesses to focus on growth, client experience and strategic expansion rather than backend infrastructure,” he adds.

However, Elston cautions that there are also responsibilities around distribution such as the IP of the price construction.

“In FX, prime of prime is about as turnkey as you can get because you don’t have the challenges of market data but you do have the challenges of heavily commoditised pricing,” he says. “The top products that your average retail brokerage would want are probably divided into index and commodity on one side and FX on the other and I would suggest that FX is probably the easier one to achieve and treat as though it was fully turnkey. The index market is tougher because it comes with more obligation.”

Looking ahead, Aagaard suggests the real differentiator will be firms that can combine regulated, deep liquidity with institutional-grade infrastructure and compliance.

“We see this not just as a trend, but as a permanent restructuring of the brokerage value chain; one that rewards expertise, regulation and client-centric innovation,” he concludes.

Moving into the B2B space is an opportunity for brokers to diversify revenue streams and reduce dependency on retail flows – but it’s no quick fix for those looking to bump up their margins.

Growing competition in retail trading coupled with rising customer expectations has made acting as a liquidity provider seem like a logical progression for many brokers.

A Natural Evolution for Brokers

Paul Jackson, head of sales at Finalto, describes it as a natural evolution for brokers with established internal infrastructure, while Pete Mulmat, CEO of tastyfx says it aligns with industry trends toward expanding asset classes and service offerings and benefits the existing business downstream by giving clients flexibility and competitive pricing as higher margins are retained in-house.

There is also a risk management element to this shift suggests Arthur Azizov, founder of liquidity provider turnkey solutions developer, B2 Ventures.

“Relying purely on retail flow is becoming less viable,” he says. “Expanding into B2B allows brokers to attract more sophisticated clients and gain greater control over pricing and execution. It’s all about building resilience in a market that is constantly shifting.”

However, new brokers often face significant challenges when trying to access liquidity from Tier 1 banks and prime brokers. These challenges include stringent credit requirements, high capital thresholds and the need for established relationships.

Michael Aagaard, Managing Director, GCEX

Additionally, the complex regulatory environment and the requirement for advanced technological infrastructure can be prohibitive for smaller firms.

“Regulatory challenges include compliance with stringent financial regulations, anti-money laundering laws and know-your-customer requirements,” explains Michael Aagaard, managing director GCEX. “Operationally, brokers must invest in robust risk management systems, advanced trading platforms and high speed connectivity to ensure efficient and reliable liquidity provision.”

You may also like: White Label, Big Bill? The Hidden Costs of Going Plug-and-Play in Prop Trading

Purveyors of Prime of Prime Recycled Liquidity

There are many firms promoting institutional FX liquidity when what they mean is that they are purveyors of prime of prime recycled liquidity – taking a bunch of other liquidity feeds and wrapping them up into a best bid offer model, sticking on a small amount of price widening and maybe a few dollars per million for the execution cost and hoping for the best suggests Richard Elston, head of institutional at CMC Markets.

Richard Elston, Group Head of Institutional at CMC Connect; Source: LinkedIn

“There is probably a market for that but it is likely to be to those much smaller brokers that operate in an offshore capacity,” he says. “If you’re operating in a tier one jurisdiction as a retail broker you will probably want to face a larger entity.”

In addition, as a prime of prime provider you are effectively a middleman and would have to put quite a bit of capital up for probably quite a small return per million traded, especially in the popular crosses.

When a broker shifts from serving end clients to serving other businesses, everything changes. B2B relationships often require different licensing structures (sometimes across multiple jurisdictions) and depending on the products and client types, this might involve dealing with additional capital requirements, reporting standards or even new categories of regulatory oversight.

“Operationally, expectations rise sharply,” acknowledges Azizov. “B2C operations can often afford minor inefficiencies or platform hiccups. In B2B, however, the tolerance for error is close to zero. Failures – either technical or procedural – can damage reputations quickly and irreversibly.”

Moreover, B2B service providers need to invest in specialised infrastructure and personnel. So it is not just about offering trading platforms but ensuring deep liquidity, reliable pricing, fast execution and flexible integrations.

According to Azizov, many brokers underestimate the complexity of this transition. What worked for retail doesn’t automatically scale to institutional and those who don’t plan for that often find themselves overwhelmed by the operational demands.

Arthur Azizov, Founder and CEO of B2Broker, Source: LinkedIn

Brokers may be required to upgrade or acquire new licences when transitioning from a brokerage model to liquidity provider and capital requirements are generally higher when acting as a market maker and taking on principal risk agrees Jackson.

“Liquidity providers must also abide by stringent market conduct rules, in terms of best execution and pre- and post-trade reporting,” he says. “From an operational standpoint, a liquidity provider’s technical infrastructure must be fast and robust, with ongoing investment backed up by superior risk surveillance and support.”

Read more: Beyond Exotic Pairs – Brokers Focus More on Enhancing Services in Low Volatile Market

Bilateral Conversations Between Maker and Taker Are Most Successful

Elston says the most successful relationships he has from a liquidity provider perspective are those where there are bilateral conversations between maker and taker.

“There are several kinds of taker out there,” he adds. “If they are effectively little more than marketing vehicles looking to grab as many clients as they can, it becomes really hard to have that sophisticated conversation. You need to be dealing with a trading desk that has a really good understanding of the underlying flow.”

There are many genuine liquidity providers in FX, but many brokers would struggle to get a seat at the table of the top tier – which is why there is a place for redistribution of FX liquidity through prime of prime brokers.

The challenges outlined above have driven the emergence of turnkey liquidity provider infrastructure solutions.

Pete Mulmat, CEO of tastyfx

“This approach gives brokers a proven, ready-to-launch system while still allowing for strategic adjustments to fit their specific business needs, balancing the efficiency of turnkey solutions with enough flexibility to make it their own,” says Mulmat.

Jackson observes that these ready-made platforms provide instant access to deep, multi-asset liquidity, built-in risk management, regulatory compliance tools and ongoing technical support, eliminating the need for extensive in-house development.

Paul Jackson, Head of Sales at Finalto

“With lower upfront costs, faster time to market and scalable, white label-ready options, they allow businesses to focus on growth, client experience and strategic expansion rather than backend infrastructure,” he adds.

However, Elston cautions that there are also responsibilities around distribution such as the IP of the price construction.

“In FX, prime of prime is about as turnkey as you can get because you don’t have the challenges of market data but you do have the challenges of heavily commoditised pricing,” he says. “The top products that your average retail brokerage would want are probably divided into index and commodity on one side and FX on the other and I would suggest that FX is probably the easier one to achieve and treat as though it was fully turnkey. The index market is tougher because it comes with more obligation.”

Looking ahead, Aagaard suggests the real differentiator will be firms that can combine regulated, deep liquidity with institutional-grade infrastructure and compliance.

“We see this not just as a trend, but as a permanent restructuring of the brokerage value chain; one that rewards expertise, regulation and client-centric innovation,” he concludes.