Spain’s

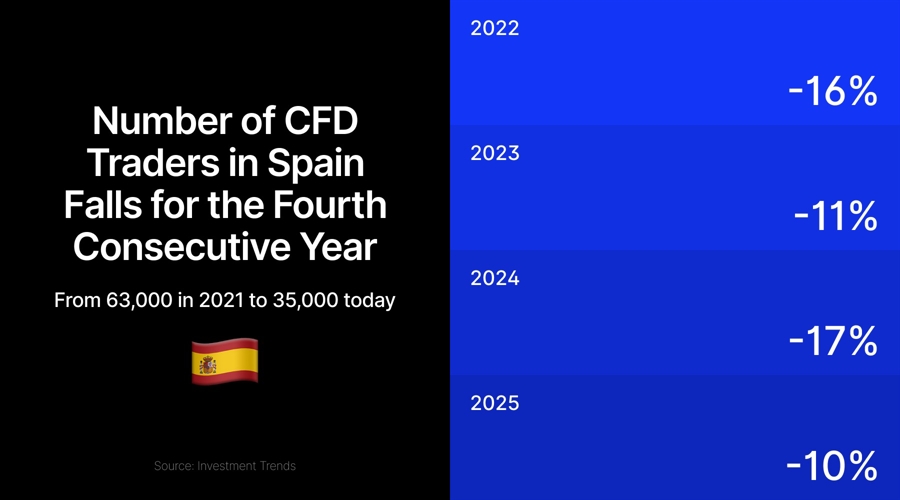

leverage trading market has collapsed to a fraction of its 2021 peak, with the

number of active FX/CFD traders falling another 10% to just 35,000 in the 12

months through February, according to a new report from Investment Trends.

Lorenzo Vignati, Associate Research Director at Investment Trends

The visible

contraction from pandemic highs continues amid record-low new trader sign-ups,

partly attributed to digital marketing restrictions and increasingly

challenging acquisition conditions, the research firm said in its 2025 Spain

Leverage Trading Report released this week.

“With

fewer Spanish traders entering the market, the imperative has shifted-retaining

the existing client base is now the strongest growth lever,” said Lorenzo

Vignati, Associate Research Director at Investment Trends.

“Retention is no longer a defensive play; it’s a primary business

strategy.”

You may

also like this: You

Want to Combat CFD Client Churn and Boost Deposits by 40%? Check Out This Tool

The report,

based on a survey of 622 traders conducted between January and February,

reveals a significant shift in how investors approach the market. While

most traditionally begin with shares or ETFs, a growing number of traders

are entering directly through cryptocurrency and leveraged products, bypassing

conventional investment pathways.

“Brokers Must Break Away

from Legacy Onboarding Assumptions”

Spanish

traders now recognize an average of 6.8 trading platforms but typically use

only 1.7 providers. Key factors in platform selection include peer

recommendations, low commissions (48%), and ease of use (47%).

“Brokers

must break away from legacy onboarding assumptions,” Vignati noted.

“Today’s first-time Spanish trader could be entering straight into crypto

or CFDs-and they expect fast, intuitive support from the first click.”

The

research also found that approximately one-third of traders recall

recent innovations from their providers, most commonly improved charting

tools, copy trading enhancements, and user interface updates. These traders

consistently report higher satisfaction levels and are more likely to recommend

their platform to others.

“Innovation

has become the clearest pathway to advocacy in Spain’s leverage trading

market,” Vignati added. “It’s not just about making improvements-it’s

about making them visible.”

The report

suggests that in an environment where new user acquisition has become

increasingly difficult and the market has contracted to nearly a half of its

size at the 2021 peak, trading platforms must focus on retention strategies and

ensuring that existing clients notice and value platform improvements.

Germany, France, and

Singapore Face the Same Challenge

Previous

reports from Investment Trends indicate that the issue extends beyond the

Spanish market, appearing in other mature and well-developed trading

environments.

In France,

the number of FX/CFD traders has

dropped below 30,000—its lowest level in four years. In Singapore, interest

in contracts for difference has

fallen to its lowest point since 2019, with retail traders showing a

growing preference for proprietary trading instead.

In Germany,

although there has been a slight rebound compared to 2024, CFD trading remains

well below pre-pandemic levels. The

number of active traders has declined from 84,000 to 63,000.

An

interesting exception is Poland, where

the CFD trading population has grown by 40%. Over the past five years, the

market has tripled in size, making it one of the largest in Europe—second only

to the UK.

Spain’s

leverage trading market has collapsed to a fraction of its 2021 peak, with the

number of active FX/CFD traders falling another 10% to just 35,000 in the 12

months through February, according to a new report from Investment Trends.

Lorenzo Vignati, Associate Research Director at Investment Trends

The visible

contraction from pandemic highs continues amid record-low new trader sign-ups,

partly attributed to digital marketing restrictions and increasingly

challenging acquisition conditions, the research firm said in its 2025 Spain

Leverage Trading Report released this week.

“With

fewer Spanish traders entering the market, the imperative has shifted-retaining

the existing client base is now the strongest growth lever,” said Lorenzo

Vignati, Associate Research Director at Investment Trends.

“Retention is no longer a defensive play; it’s a primary business

strategy.”

You may

also like this: You

Want to Combat CFD Client Churn and Boost Deposits by 40%? Check Out This Tool

The report,

based on a survey of 622 traders conducted between January and February,

reveals a significant shift in how investors approach the market. While

most traditionally begin with shares or ETFs, a growing number of traders

are entering directly through cryptocurrency and leveraged products, bypassing

conventional investment pathways.

“Brokers Must Break Away

from Legacy Onboarding Assumptions”

Spanish

traders now recognize an average of 6.8 trading platforms but typically use

only 1.7 providers. Key factors in platform selection include peer

recommendations, low commissions (48%), and ease of use (47%).

“Brokers

must break away from legacy onboarding assumptions,” Vignati noted.

“Today’s first-time Spanish trader could be entering straight into crypto

or CFDs-and they expect fast, intuitive support from the first click.”

The

research also found that approximately one-third of traders recall

recent innovations from their providers, most commonly improved charting

tools, copy trading enhancements, and user interface updates. These traders

consistently report higher satisfaction levels and are more likely to recommend

their platform to others.

“Innovation

has become the clearest pathway to advocacy in Spain’s leverage trading

market,” Vignati added. “It’s not just about making improvements-it’s

about making them visible.”

The report

suggests that in an environment where new user acquisition has become

increasingly difficult and the market has contracted to nearly a half of its

size at the 2021 peak, trading platforms must focus on retention strategies and

ensuring that existing clients notice and value platform improvements.

Germany, France, and

Singapore Face the Same Challenge

Previous

reports from Investment Trends indicate that the issue extends beyond the

Spanish market, appearing in other mature and well-developed trading

environments.

In France,

the number of FX/CFD traders has

dropped below 30,000—its lowest level in four years. In Singapore, interest

in contracts for difference has

fallen to its lowest point since 2019, with retail traders showing a

growing preference for proprietary trading instead.

In Germany,

although there has been a slight rebound compared to 2024, CFD trading remains

well below pre-pandemic levels. The

number of active traders has declined from 84,000 to 63,000.

An

interesting exception is Poland, where

the CFD trading population has grown by 40%. Over the past five years, the

market has tripled in size, making it one of the largest in Europe—second only

to the UK.