Financial technology firm CPattern has revealed performance data showing its “Guardian Angel” tool significantly increases trading activity and deposits among online traders, potentially offering FX and CFDs brokers a new approach to client retention in volatile and increasingly saturated markets.

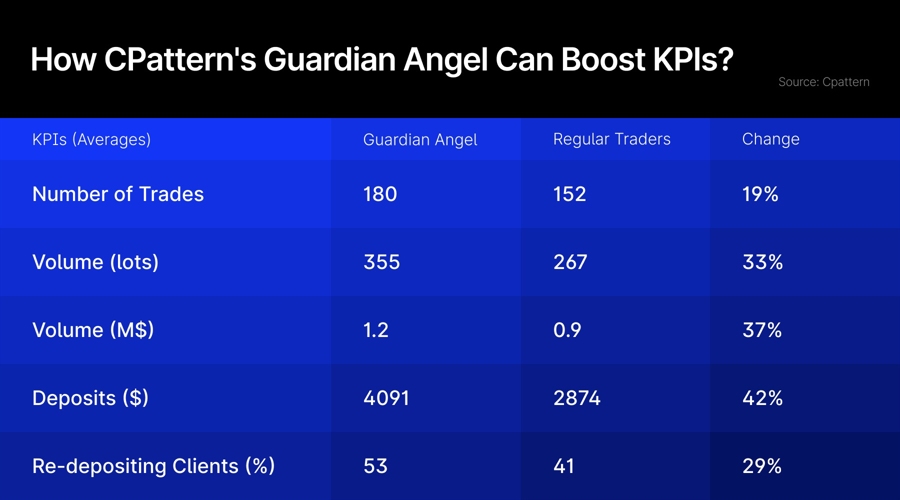

Oded Shefer, the company’s Founder and CEO, shared with FinanceMagnates.com that traders using the Guardian Angel (GA) system generate 42% higher deposits on average compared to regular users, while executing 19% more trades with 37% greater trading volume.

CPattern, established in 2009, specializes in real-time analysis of trading behavior. Its Guardian Angel tool provides personalized feedback to traders based on their unique trading activity. Moreover, it provides personalized market insight in real time through third-party providers. “The Guardian Angel relies on cognitive psychology theories where it provides reinforcement to positive behaviors and reframes negative outcomes,” Shefer explained.

The system monitors industry-standard behavioral indicators, including stop-loss usage, hedging practices, instrument diversification, and the ratio between deal size and free margin.

According to data shared with FinanceMagnates.com, in one broker’s monthly data covering 2,190 users, the 277 traders using Guardian Angel (almost 13% of the user base) contributed 24% of all deposit revenue. These clients averaged $4,091 in deposits compared to $2,874 for regular users.

The conducted analysis excludes outliers—accounts that made more than $15,000 in re-deposits—to better reveal the general trends in the collected data. So far, Guardian Angel has been tested with dozens of leading brokers and tens of thousands of users since 2010.

Measuring Effectiveness

To evaluate the tool’s impact, CPattern employs what Shefer describes as a “clinical trial method” where all traders are offered access to Guardian Angel, and performance metrics are compared between users and non-users. Once a month, the Guardian Angel group is compared to the group of traders who did not use it.

“Assuming all traders have the same access to market data and call center calls – the only difference is the Guardian Angel use,” Shefer explained. “If the Guardian Angel group shows superior performance, it is attributed to the Guardian Angel.”

The company reports consistent month-over-month increases in key metrics across demographics and experience levels, with Guardian Angel users showing “higher engagement and discipline” according to the data provided.

Out of the total deposit volume of $4.6 million, one quarter ($1.13 million) came from Guardian Angel users, who accounted for just one-eighth of all clients.

“A Novel Paradigm of Retention” for CFD Brokers

Oded Shefer, the CEO and Founder of CPattern

What’s behind the results? According to the CEO of CPattern, the increase in engagement and the rise in broker-relevant KPIs stem from an effective learning process enabled by Guardian Angel. Traders’ decisions are more informed and less driven by emotion or crowd psychology.

“CPattern promotes a novel paradigm of retention that is based on trust, confidence and responsible trading,” Shefer explained. “When traders are given the proper tool, they evolve over time and the KPIs show that they are by far more engaged compared to all other traders. This is across segments, across brokers and across time periods.”

Thus, Shefer believes that Guardian Angel could transform the way brokers encourage traders to invest and make additional deposits. Instead of offering the same worn-out trading bonuses and gamifying the industry, CFD firms could focus on building customer awareness. Early data suggests that this innovative approach is proving highly effective.

“GA users outperform regular users across all major metrics,” Shefer added. “Their smaller numbers are outweighed by higher productivity, volume, and deposit value. This highlights the benefit of structured guidance and active trader development.”

Slashing Churn Rates Through Engagement

One of the most persistent challenges for online brokers is client churn, which can significantly impact long-term profitability. The Guardian Angel system appears to directly address this issue through its focus on trader engagement and behavioral reinforcement.

“Because Guardian Angel users are far more engaged, their churn rate is much slower compared to others,” Shefer noted. This reduction in churn appears consistent across user segments, with no diminishing returns when scaled to larger user bases.

The system provides early warnings to traders before margin calls occur, which Shefer believes builds trust with users. “The Guardian Angel gives an alert to the trader that he is at risk before a margin call is observed. This increases the trader’s trust and in many cases slows down churn.”

An example of early warnings sent to traders. Source: CPattern

CPattern recently also added an artificial intelligence (AI) layer that gives traders more personalized and deeper insights.

Data indicates that Guardian Angel users not only trade more frequently but also exhibit higher re-deposit rates, with 53% of users making additional deposits compared to 41% of regular users – a 29% uplift that suggests stronger platform loyalty.

During the study period, the average user made 152 trades, while those using Guardian Angel executed 180—an increase of nearly 19%. Trading volume in lots rose by 33%, from 267 to 355. The average value of executed trades in dollar terms grew even more sharply, rising 37% from nearly $902,000 to over $1.2 million.

While CPattern doesn’t have hard data on referrals or reviews, Shefer indicated the company believes the improved user experience translates to higher platform loyalty, further contributing to reduced churn rates.

Four-Day Setup, Thirty-Fold Returns

For brokers concerned about implementation costs, CPattern Founder noted the system requires minimal operational resources. Guardian Angel is available on all major retail trading platforms, including MetaTrader 4 and 5, and is accessible via desktop, web and mobile versions.

“There is no cost. The setup takes 2-4 working days and it is completely automated. The monthly ROI is 30 times and sometimes even much higher,” he said.

This rapid deployment allows brokers to quickly test the system’s effectiveness without significant upfront investment. The automation aspect means minimal ongoing maintenance requirements, with the system operating alongside existing call center operations.

Brokers typically direct human call center resources toward larger accounts while offering automated tools like Guardian Angel to smaller traders. However, the data suggests this automated approach may actually outperform traditional human intervention for certain client segments.

In the case study provided by CPattern, Guardian Angel users contributed an additional $337,109 in a single month compared to what would have been expected from the same number of regular users.

The system’s ability to scale without diminishing returns further enhances its ROI potential. “The uplift remains constant when GA is scaled. This is a huge benefit for our clients,” Shefer concluded.

To learn more about Guardian Angel, visit CPattern’s official website or contact the company at info@cpattern.com.

Financial technology firm CPattern has revealed performance data showing its “Guardian Angel” tool significantly increases trading activity and deposits among online traders, potentially offering FX and CFDs brokers a new approach to client retention in volatile and increasingly saturated markets.

Oded Shefer, the company’s Founder and CEO, shared with FinanceMagnates.com that traders using the Guardian Angel (GA) system generate 42% higher deposits on average compared to regular users, while executing 19% more trades with 37% greater trading volume.

CPattern, established in 2009, specializes in real-time analysis of trading behavior. Its Guardian Angel tool provides personalized feedback to traders based on their unique trading activity. Moreover, it provides personalized market insight in real time through third-party providers. “The Guardian Angel relies on cognitive psychology theories where it provides reinforcement to positive behaviors and reframes negative outcomes,” Shefer explained.

The system monitors industry-standard behavioral indicators, including stop-loss usage, hedging practices, instrument diversification, and the ratio between deal size and free margin.

According to data shared with FinanceMagnates.com, in one broker’s monthly data covering 2,190 users, the 277 traders using Guardian Angel (almost 13% of the user base) contributed 24% of all deposit revenue. These clients averaged $4,091 in deposits compared to $2,874 for regular users.

The conducted analysis excludes outliers—accounts that made more than $15,000 in re-deposits—to better reveal the general trends in the collected data. So far, Guardian Angel has been tested with dozens of leading brokers and tens of thousands of users since 2010.

Measuring Effectiveness

To evaluate the tool’s impact, CPattern employs what Shefer describes as a “clinical trial method” where all traders are offered access to Guardian Angel, and performance metrics are compared between users and non-users. Once a month, the Guardian Angel group is compared to the group of traders who did not use it.

“Assuming all traders have the same access to market data and call center calls – the only difference is the Guardian Angel use,” Shefer explained. “If the Guardian Angel group shows superior performance, it is attributed to the Guardian Angel.”

The company reports consistent month-over-month increases in key metrics across demographics and experience levels, with Guardian Angel users showing “higher engagement and discipline” according to the data provided.

Out of the total deposit volume of $4.6 million, one quarter ($1.13 million) came from Guardian Angel users, who accounted for just one-eighth of all clients.

“A Novel Paradigm of Retention” for CFD Brokers

Oded Shefer, the CEO and Founder of CPattern

What’s behind the results? According to the CEO of CPattern, the increase in engagement and the rise in broker-relevant KPIs stem from an effective learning process enabled by Guardian Angel. Traders’ decisions are more informed and less driven by emotion or crowd psychology.

“CPattern promotes a novel paradigm of retention that is based on trust, confidence and responsible trading,” Shefer explained. “When traders are given the proper tool, they evolve over time and the KPIs show that they are by far more engaged compared to all other traders. This is across segments, across brokers and across time periods.”

Thus, Shefer believes that Guardian Angel could transform the way brokers encourage traders to invest and make additional deposits. Instead of offering the same worn-out trading bonuses and gamifying the industry, CFD firms could focus on building customer awareness. Early data suggests that this innovative approach is proving highly effective.

“GA users outperform regular users across all major metrics,” Shefer added. “Their smaller numbers are outweighed by higher productivity, volume, and deposit value. This highlights the benefit of structured guidance and active trader development.”

Slashing Churn Rates Through Engagement

One of the most persistent challenges for online brokers is client churn, which can significantly impact long-term profitability. The Guardian Angel system appears to directly address this issue through its focus on trader engagement and behavioral reinforcement.

“Because Guardian Angel users are far more engaged, their churn rate is much slower compared to others,” Shefer noted. This reduction in churn appears consistent across user segments, with no diminishing returns when scaled to larger user bases.

The system provides early warnings to traders before margin calls occur, which Shefer believes builds trust with users. “The Guardian Angel gives an alert to the trader that he is at risk before a margin call is observed. This increases the trader’s trust and in many cases slows down churn.”

An example of early warnings sent to traders. Source: CPattern

CPattern recently also added an artificial intelligence (AI) layer that gives traders more personalized and deeper insights.

Data indicates that Guardian Angel users not only trade more frequently but also exhibit higher re-deposit rates, with 53% of users making additional deposits compared to 41% of regular users – a 29% uplift that suggests stronger platform loyalty.

During the study period, the average user made 152 trades, while those using Guardian Angel executed 180—an increase of nearly 19%. Trading volume in lots rose by 33%, from 267 to 355. The average value of executed trades in dollar terms grew even more sharply, rising 37% from nearly $902,000 to over $1.2 million.

While CPattern doesn’t have hard data on referrals or reviews, Shefer indicated the company believes the improved user experience translates to higher platform loyalty, further contributing to reduced churn rates.

Four-Day Setup, Thirty-Fold Returns

For brokers concerned about implementation costs, CPattern Founder noted the system requires minimal operational resources. Guardian Angel is available on all major retail trading platforms, including MetaTrader 4 and 5, and is accessible via desktop, web and mobile versions.

“There is no cost. The setup takes 2-4 working days and it is completely automated. The monthly ROI is 30 times and sometimes even much higher,” he said.

This rapid deployment allows brokers to quickly test the system’s effectiveness without significant upfront investment. The automation aspect means minimal ongoing maintenance requirements, with the system operating alongside existing call center operations.

Brokers typically direct human call center resources toward larger accounts while offering automated tools like Guardian Angel to smaller traders. However, the data suggests this automated approach may actually outperform traditional human intervention for certain client segments.

In the case study provided by CPattern, Guardian Angel users contributed an additional $337,109 in a single month compared to what would have been expected from the same number of regular users.

The system’s ability to scale without diminishing returns further enhances its ROI potential. “The uplift remains constant when GA is scaled. This is a huge benefit for our clients,” Shefer concluded.

To learn more about Guardian Angel, visit CPattern’s official website or contact the company at info@cpattern.com.