Cryptocurrency

exchange trading volumes decreased by 15% in March 2025 compared to the

previous month, marking the third consecutive monthly decline in trading

activity across major platforms.

The

declines coincided with Bitcoin’s weakening performance. Although its price

contracted by only 2% last month, it briefly fell to $75,000 — the lowest level

since November.

According

to data from Finance Magnates Intelligence and The Block, total

trading volume across the top ten cryptocurrency exchanges fell to $1.13

trillion in March from

$1.33 trillion in Februaryc, reflecting cooling market sentiment after the

robust trading activity seen in late 2024 and early 2025.

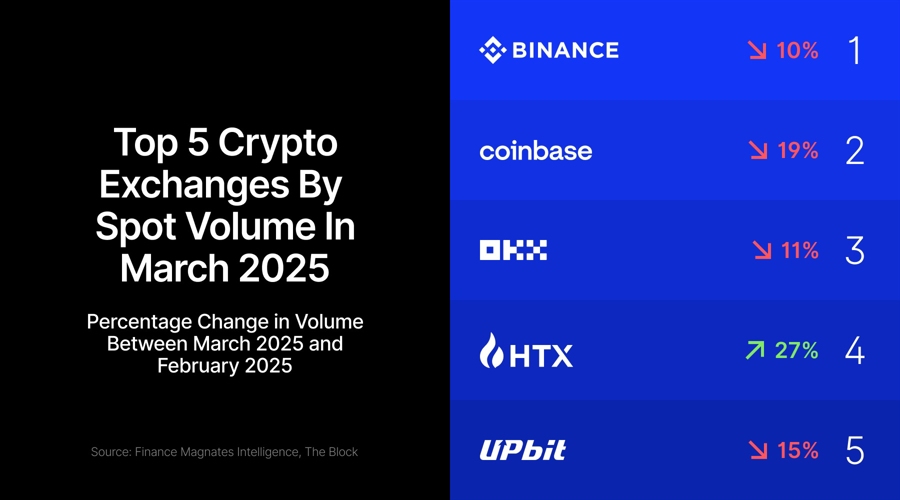

Despite the

overall market contraction, Binance maintained its dominant position with a

51.8% market share, though its trading volume dropped 10.4% month-over-month to

$583.5 billion. The exchange also showed year-over-year slump of 48% compared

to March 2024.

Coinbase,

the second-largest exchange by volume, experienced a more significant decline

of 18.7% month-over-month, with trading volume falling to $102.1 billion. Moreover,

the U.S.-based exchange recorded a 35% decrease compared to the same period

last year.

OKX

maintained its third position with $96.8 billion in trading volume, down 10.8%

from February and down 43% year-over-year.

Conditions are certainly unfavorable at the moment, and according to Dr. Kirill Kretov of CoinPanel, they’re unlikely to improve anytime soon. “We are deep in a risk-off environment with geopolitical stress, shaky economies, and drained liquidity across the board,” he told FinanceMagnates.com.

“The chaos coming out of the new U.S. administration—one vague statement or policy tease is enough to rattle even traditional markets. In crypto, which is far thinner and more reactive, that kind of uncertainty hits like a sledgehammer.”

Huobi Bucked The Downward

Trend

The most

notable performer was Huobi, which bucked the downward trend with a 27.5%

increase in trading volume compared to February, reaching $92.6 billion. This

also represented a 12% growth compared to March 2024, allowing Huobi to climb

to fourth place in the rankings.

Meanwhile,

ByBit experienced the steepest decline among major exchanges, with volumes

falling 52.4% month-over-month to $84.3 billion, and -55% compared to the same

period last year.

The data

reveals a significant cooling from the peak trading period observed in late

2024, when monthly volumes exceeded $2 trillion in November and December.

March’s $1.13 trillion total represents a 47.4% decrease from December 2024’s

high of $2.14 trillion.

March

2024 was one of the strongest months on record for crypto exchange volumes,

as Bitcoin climbed 17% to what was then a record high of nearly $74,000.

Although Bitcoin is now trading at a higher price, overall market sentiment has

deteriorated.

This Expert Predicts BTC

Price Drop to $10,000

Bitcoin’s

downward trend is continuing, with prices falling below the $80,000

threshold and testing key support levels around $74,500 this month. This latest

drop follows a steep decline from the year’s peak of $109,000, signaling

mounting pressure on the cryptocurrency market amid broader economic headwinds.

Bloomberg

Senior Commodity Strategist Mike McGlone has issued a stark warning,

forecasting that Bitcoin could plunge as low as $10,000. Drawing

comparisons to the early 2000s dot-com crash, McGlone points to speculative

excess, macroeconomic tightening, and the loss of Bitcoin’s “digital

gold” narrative as factors that could trigger a deep market correction.

What does HODL stand for? Everyone’s in for the long-term, as long as it’s going up. Did not know how #Bitcoin was going to get to $100,000 from $10,000 in 2020, but the trends showed up. Now, I see the reversion path back toward $10,000. The technology is awesome as evidenced by…

— Mike McGlone (@mikemcglone11) April 6, 2025

“In 2020,

Bitcoin was at 10,000. It was only a few years ago. I think it’s going back

there,” McGlone said in a recent interview. This bold prediction raises

important questions: How low can Bitcoin go? What’s driving this potential

plunge? And how should you protect your portfolio?

While some

analysts remain optimistic about Bitcoin’s long-term prospects, McGlone’s

forecast stands out for its severity. He argues that the crypto space needs a

major reset and suggests that Bitcoin’s return to $10,000 would be a reversion

to more sustainable valuation levels following years of speculative growth.

Cryptocurrency

exchange trading volumes decreased by 15% in March 2025 compared to the

previous month, marking the third consecutive monthly decline in trading

activity across major platforms.

The

declines coincided with Bitcoin’s weakening performance. Although its price

contracted by only 2% last month, it briefly fell to $75,000 — the lowest level

since November.

According

to data from Finance Magnates Intelligence and The Block, total

trading volume across the top ten cryptocurrency exchanges fell to $1.13

trillion in March from

$1.33 trillion in Februaryc, reflecting cooling market sentiment after the

robust trading activity seen in late 2024 and early 2025.

Despite the

overall market contraction, Binance maintained its dominant position with a

51.8% market share, though its trading volume dropped 10.4% month-over-month to

$583.5 billion. The exchange also showed year-over-year slump of 48% compared

to March 2024.

Coinbase,

the second-largest exchange by volume, experienced a more significant decline

of 18.7% month-over-month, with trading volume falling to $102.1 billion. Moreover,

the U.S.-based exchange recorded a 35% decrease compared to the same period

last year.

OKX

maintained its third position with $96.8 billion in trading volume, down 10.8%

from February and down 43% year-over-year.

Conditions are certainly unfavorable at the moment, and according to Dr. Kirill Kretov of CoinPanel, they’re unlikely to improve anytime soon. “We are deep in a risk-off environment with geopolitical stress, shaky economies, and drained liquidity across the board,” he told FinanceMagnates.com.

“The chaos coming out of the new U.S. administration—one vague statement or policy tease is enough to rattle even traditional markets. In crypto, which is far thinner and more reactive, that kind of uncertainty hits like a sledgehammer.”

Huobi Bucked The Downward

Trend

The most

notable performer was Huobi, which bucked the downward trend with a 27.5%

increase in trading volume compared to February, reaching $92.6 billion. This

also represented a 12% growth compared to March 2024, allowing Huobi to climb

to fourth place in the rankings.

Meanwhile,

ByBit experienced the steepest decline among major exchanges, with volumes

falling 52.4% month-over-month to $84.3 billion, and -55% compared to the same

period last year.

The data

reveals a significant cooling from the peak trading period observed in late

2024, when monthly volumes exceeded $2 trillion in November and December.

March’s $1.13 trillion total represents a 47.4% decrease from December 2024’s

high of $2.14 trillion.

March

2024 was one of the strongest months on record for crypto exchange volumes,

as Bitcoin climbed 17% to what was then a record high of nearly $74,000.

Although Bitcoin is now trading at a higher price, overall market sentiment has

deteriorated.

This Expert Predicts BTC

Price Drop to $10,000

Bitcoin’s

downward trend is continuing, with prices falling below the $80,000

threshold and testing key support levels around $74,500 this month. This latest

drop follows a steep decline from the year’s peak of $109,000, signaling

mounting pressure on the cryptocurrency market amid broader economic headwinds.

Bloomberg

Senior Commodity Strategist Mike McGlone has issued a stark warning,

forecasting that Bitcoin could plunge as low as $10,000. Drawing

comparisons to the early 2000s dot-com crash, McGlone points to speculative

excess, macroeconomic tightening, and the loss of Bitcoin’s “digital

gold” narrative as factors that could trigger a deep market correction.

What does HODL stand for? Everyone’s in for the long-term, as long as it’s going up. Did not know how #Bitcoin was going to get to $100,000 from $10,000 in 2020, but the trends showed up. Now, I see the reversion path back toward $10,000. The technology is awesome as evidenced by…

— Mike McGlone (@mikemcglone11) April 6, 2025

“In 2020,

Bitcoin was at 10,000. It was only a few years ago. I think it’s going back

there,” McGlone said in a recent interview. This bold prediction raises

important questions: How low can Bitcoin go? What’s driving this potential

plunge? And how should you protect your portfolio?

While some

analysts remain optimistic about Bitcoin’s long-term prospects, McGlone’s

forecast stands out for its severity. He argues that the crypto space needs a

major reset and suggests that Bitcoin’s return to $10,000 would be a reversion

to more sustainable valuation levels following years of speculative growth.