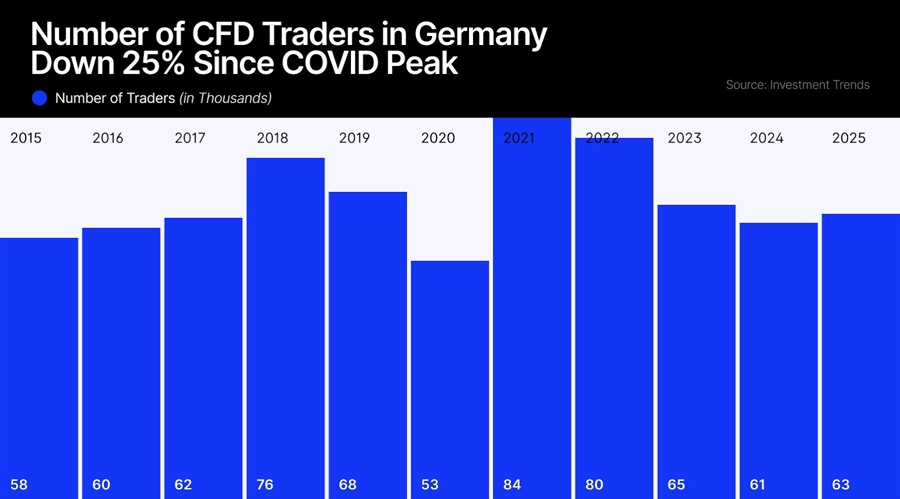

Germany’s

leveraged trading market has reversed course, growing 3% to reach 63,000 active

CFD and forex traders in the 12 months to February 2025, according to a new

report from market research firm Investment Trends.

The

increase marks the first positive growth after three consecutive years of

contraction following the pandemic-driven peak in 2021.

The number

of traders in Germany’s CFD/FX market remains 25% below the COVID-era high of

84,000 recorded in March 2021, but the latest figures suggest the market may

finally be stabilizing after a prolonged adjustment period.

Lorenzo Vignati, Associate Research Director at Investment Trends

“This

marks an important turning point for Germany’s CFD/FX market,” said

Lorenzo Vignati, Associate Research Director at Investment Trends.

“The market has weathered a difficult period of contraction, but we’re now

seeing signs of sustainable recovery.”

However,

63,000 is still a relatively small number compared to

the 1.8 million active online investors in Germany, according to a separate

report by Investment Trends published in early April. The report also showed

that as many as 16% of respondents had changed or were in the process of

changing their broker.

The rebound

in FX/CFDs client base has been driven by a combination of factors, including

the reactivation of dormant traders and improved retention rates. The report,

based on a survey of 11,680 investors conducted between January and February

2025, revealed changing dynamics in how new participants enter the leveraged

trading market.

From ETFs to CFDs

While

shares and ETFs remain the primary gateway to trading for most Germans (72%),

the pathways are diversifying. Among new entrants to CFD/FX trading, 33% now

come with experience in listed derivatives and 27% arrive from cryptocurrency

markets – signaling an evolution in trader profiles and expectations.

“The

profile of the new leveraged trader in Germany is evolving,” Vignati

noted. “They’re arriving more informed, more product-aware, and with

different expectations of what a trading platform should deliver.”

The German

market’s recovery comes after a period of significant volatility. After

reaching a pandemic-driven peak of 84,000 traders in March 2021, the market

experienced three consecutive years of decline, with dormancy rates fluctuating

between 37% and 39%. This year’s positive growth suggests the market may have

found its footing after the extended correction period.

“Cross-Sell Appetite in

Germany Is Strong”

The report

also highlighted significant untapped potential for brokers to cross-sell

products. Despite 84% of German CFD/FX traders expressing openness to using

additional services from their main provider, only 26% of multi-asset traders

currently consolidate their trading and investing on a single platform.

This

disconnect points to a substantial opportunity for trading platforms that can

create more seamless experiences.

“Cross-sell

appetite in Germany is strong, but the experience gap is real,” said

Vignati. “To unlock value, providers need to build platforms that

genuinely integrate trading and investing.”

Moreover,

the German leveraged trading market has demonstrated resilience over the long

term, growing from 51,000 traders in April 2012 to the current 63,000 –

representing 23.5% growth over 13 years despite significant fluctuations along

the way.

Germany

vs. the Rest of the World

How does

the German CFD market compare to other major jurisdictions? In Hong Kong, around

100,000 individuals are engaged in trading such instruments.

Germany,

however, fares better

than Singapore, where only 38,000 people executed leveraged trades in 2024.

The popularity of the FX/CFD market is also declining in France,

where 29,000 people currently trade these instruments—down from a peak of

38,000 during the pandemic.

Germany’s

leveraged trading market has reversed course, growing 3% to reach 63,000 active

CFD and forex traders in the 12 months to February 2025, according to a new

report from market research firm Investment Trends.

The

increase marks the first positive growth after three consecutive years of

contraction following the pandemic-driven peak in 2021.

The number

of traders in Germany’s CFD/FX market remains 25% below the COVID-era high of

84,000 recorded in March 2021, but the latest figures suggest the market may

finally be stabilizing after a prolonged adjustment period.

Lorenzo Vignati, Associate Research Director at Investment Trends

“This

marks an important turning point for Germany’s CFD/FX market,” said

Lorenzo Vignati, Associate Research Director at Investment Trends.

“The market has weathered a difficult period of contraction, but we’re now

seeing signs of sustainable recovery.”

However,

63,000 is still a relatively small number compared to

the 1.8 million active online investors in Germany, according to a separate

report by Investment Trends published in early April. The report also showed

that as many as 16% of respondents had changed or were in the process of

changing their broker.

The rebound

in FX/CFDs client base has been driven by a combination of factors, including

the reactivation of dormant traders and improved retention rates. The report,

based on a survey of 11,680 investors conducted between January and February

2025, revealed changing dynamics in how new participants enter the leveraged

trading market.

From ETFs to CFDs

While

shares and ETFs remain the primary gateway to trading for most Germans (72%),

the pathways are diversifying. Among new entrants to CFD/FX trading, 33% now

come with experience in listed derivatives and 27% arrive from cryptocurrency

markets – signaling an evolution in trader profiles and expectations.

“The

profile of the new leveraged trader in Germany is evolving,” Vignati

noted. “They’re arriving more informed, more product-aware, and with

different expectations of what a trading platform should deliver.”

The German

market’s recovery comes after a period of significant volatility. After

reaching a pandemic-driven peak of 84,000 traders in March 2021, the market

experienced three consecutive years of decline, with dormancy rates fluctuating

between 37% and 39%. This year’s positive growth suggests the market may have

found its footing after the extended correction period.

“Cross-Sell Appetite in

Germany Is Strong”

The report

also highlighted significant untapped potential for brokers to cross-sell

products. Despite 84% of German CFD/FX traders expressing openness to using

additional services from their main provider, only 26% of multi-asset traders

currently consolidate their trading and investing on a single platform.

This

disconnect points to a substantial opportunity for trading platforms that can

create more seamless experiences.

“Cross-sell

appetite in Germany is strong, but the experience gap is real,” said

Vignati. “To unlock value, providers need to build platforms that

genuinely integrate trading and investing.”

Moreover,

the German leveraged trading market has demonstrated resilience over the long

term, growing from 51,000 traders in April 2012 to the current 63,000 –

representing 23.5% growth over 13 years despite significant fluctuations along

the way.

Germany

vs. the Rest of the World

How does

the German CFD market compare to other major jurisdictions? In Hong Kong, around

100,000 individuals are engaged in trading such instruments.

Germany,

however, fares better

than Singapore, where only 38,000 people executed leveraged trades in 2024.

The popularity of the FX/CFD market is also declining in France,

where 29,000 people currently trade these instruments—down from a peak of

38,000 during the pandemic.