The Swiss Financial Market Supervisory Authority (FINMA) has

published the findings of a recent survey on artificial intelligence (AI) use

among financial institutions in Switzerland. The survey was conducted between

late November 2024 and mid-January 2025.

FINMA surveyed approximately 400 licensed institutions.

These included banks, securities firms, insurance companies, insurance

intermediaries, fund managers, and market infrastructure providers.

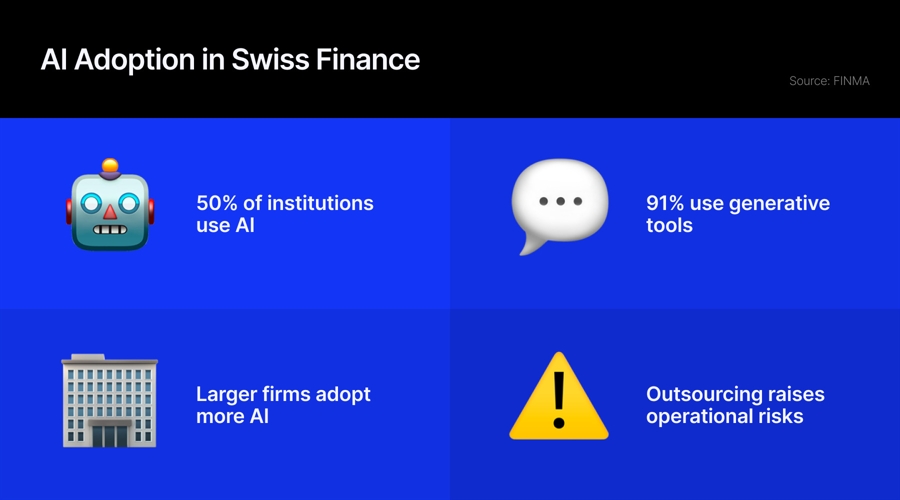

Widespread Use of AI

Around half of the surveyed institutions currently use AI or

have pilot applications underway. An additional 25% plan to adopt AI within the

next three years. On average, each respondent uses five AI applications and has

nine more in development. Larger institutions tend to have more AI use cases

than smaller ones.

Among AI users, 91% make use of generative AI tools, such as

modern chatbots. Many institutions rely on services from large technology

providers. FINMA noted a growing dependence on external vendors, especially

among smaller firms that often do not develop AI tools in-house.

An #AI Future For Financial Sector#MachineLearning #DeepLearning #BigData #Fintech #ML #DL #Robotics #insurtech https://t.co/OkT8ssYKVz pic.twitter.com/NbqUn8Rvk2

— AI (@DeepLearn007) September 20, 2017

This reliance increases outsourcing risks. FINMA highlighted

these risks in its 2024 Risk Monitor, stating that outsourcing critical

functions to third parties remains a major operational concern for the

financial sector.

You may find it interesting at FinanceMagnates.com: AI

Will Take Your Job — CEOs Say Deal with It — What Can You Do?

AI Governance and Risk Management

About 50% of institutions have established a formal AI

strategy. Most organisations manage AI under existing governance systems,

focusing on data protection, cybersecurity, data management, and enterprise

risk management.

Institutions identified key risks linked to AI. These

include concerns about data quality, data protection, and the explainability of

AI decisions. Respondents also raised issues about data security, incorrect

outputs, and outsourcing-related risks.

Sector Breakdown

Of the 187 institutions currently using AI, 100 are banks

and securities firms. Seventy-five are insurance companies and intermediaries.

The remaining 12 include fund managers and financial market infrastructure

operators.

“FINMA will ensure that the use of new and innovative

technologies on the Swiss financial market is in line with the regulatory

framework through transparent and technology-neutral authorisation and

supervisory activities,” the regulator stated.

“In doing so, FINMA will follow the principle of ‘same

business, same risks, same rules’. The objective of the survey was to track the

development of the use along with the governance and risk management of AI in

order to ensure a risk-based supervisory approach.”

This article was written by Tareq Sikder at www.financemagnates.com.

Source link