“We’re excited to support stablecoins, with near-instant,

near-free global transactions”: this line stood out in Stripe’s 2024 annual letter.

That was not just an product update. It was a signal. One

of the world’s most trusted fintech platforms is throwing its weight behind

stablecoins as default rails for global commerce. And indeed Stripe did it: it acquired stablecoin-focused startup Bridge for $1.1 billion. Another notable deal that has been made to make stablecoin mainstream is the $1.25 billion acquisition of Hidden Road by Ripple.

In parallel, Brian Armstrong, Coinbase CEO, seconded the potential in a recent

tweet on X, calling on U.S. regulators to speed up work on stablecoins. He

noted that more than $150 billion in stablecoins are now circulating worldwide,

acting as a medium of exchange, store of value, and cross-border payment rail.

This transition isn’t hypothetical. It’s already occurring at scale.

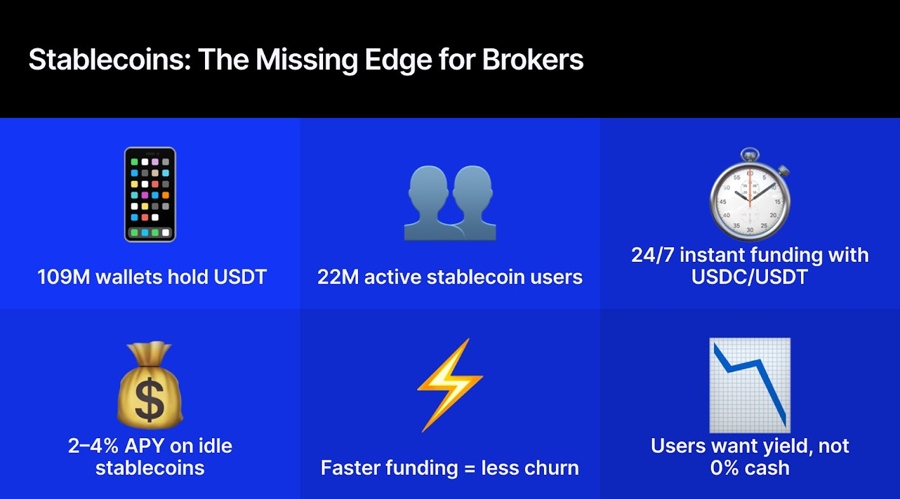

Tether recently reported that over 109 million on-chain

wallets hold USDT, with 54 million wallets holding over $0.01. The remaining

stablecoins (like USDC, DAI, and FDUSD) account for another 13.8 million

wallets with significant balances. And stablecoin active wallets were at 22

million by the end of 2024.

— Brian Armstrong (@brian_armstrong) March 31, 2025

One must ask: Why have fewer retail brokerages centered

stablecoins as the core of their offerings? As the potential is vast, its and not only

operational, but a strategic decision.

Strategic Advantage of Adopting Stablecoins

The three key levers where retail brokers have a unique opportunity to leverage

stablecoins are funding speed, possible yield , and

marketing distinction.

1. Instant Stablecoin

Funding: One of the most significant challenges for retail clients is

the inconvenience around funding accounts. Legacy approaches—ACH, wires, credit

cards—take time, come with fees, or are limiting. And stablecoins can make this process near instant.

There will also be the advantage of 24×7, borderless lending at near-zero cost.

Emerging market customers can further bypass local banking

hurdles and top up their accounts with USDC or USDT directly from a

cryptocurrency wallet.

Additionally, local customers will not need to wait hours (or days) for

deposits to clear.

For brokers, this means faster activation, more integrated

user experience, and reduced operational overhead. And, it gives them an

always-on revenue stream—traders don’t need to be bound by banking hours, and

neither do brokers. It will ultimately result in lower conversion costs, higher conversion

rates and potentially quicker revenue generation.

When Stripe is already enabling stablecoin payouts to merchants

and gig workers, retail brokers need to be asking themselves: Why not traders

too?

2. Yield on Idle Stablecoin Balances: With more competitive rates elsewhere in the

globe, customers are yield-sensitive as never before. Leaving money idle in a

0% payout brokerage account no longer makes sense. Stablecoins can create a new value proposition here. One of the offerings by brokers can be enabling traders to earn

interest on USDC balances—without investing in riskier assets.

Brokers

can be compatible with platforms that earn yields or maintain reserves to split

part of the profits with customers. Even a 2–4% APY on idle stablecoin balances

makes the platform more sticky, competitive, and customer-friendly.

It has already been embraced by neobanks and crypto wallets—why not brokerages?

Why it matters: Paying yield on stablecoin balances isn’t a

nicety—it’s getting to table stakes in an economy where consumers are asking

for money to make their money.

3. Marketing Differentiation: The fintech market is saturated. Brokers are differentiating

on fees, UX, access to assets, and learning tools. Stablecoins offer up a new

marketing point of difference that resonates with digitally-native customers.

Imagine launching your next campaign with: “Fund instantly. Trade

everywhere. Get paid while you wait.”

That’s a compelling narrative—especially to young,

crypto-savvy, and international traders who expect seamless experiences and

borderless access. By offering USDC or USDT wallets, instant funding, and

yield, brokers can redefine themselves as innovative, borderless, and

responsive to user needs.

This isn’t about crypto—it’s about user experience.

How Stablecoins Can Change Funding

Let’s look at an example retail brokerage—hypothetical Broker

X.

Now, their clients fund accounts via bank transfer or debit

card. Settlement is 1–2 days. Cash gets 0%. And tickets regarding funding

problems are piling up.

Now imagine Broker X

has stablecoin rails:

• A Brazilian

trader funds their account with USDC directly from a crypto wallet.

• They start

trading right away—no FX conversion, no fees.

• When idle,

their USDC earns 3% APY.

• When they draw out profits, it settles into their wallet in

less than a minute.

That’s not just a technical upgrade. That’s a business advantage—less

churn, higher satisfaction, and more referrals.

Excited to power onchain stablecoin insights for Bridge’s @stablecoin new blog series

Artemis charts track everything from supply and transaction volume (MEV/intra-CEX stripped) to active wallets – across 50+ stablecoins and chains – bringing a clearer view of real usage.

Check… pic.twitter.com/U5UEsPuTma

— Artemis (@artemis) April 7, 2025

What’s Holding Brokers Back?

Too many brokers are still holding back, even with the clear

benefits. Why?

• Regulatory uncertainty: Compliance teams are still

wrestling with how to handle stablecoin flows. This starts to clear up with

more countries implementing regulatory framework around stablecoins.

• Operational integration: Adding stablecoin rails isn’t

plug-and-play (yet).

• Perception: Some still view stablecoins as “crypto

adjacent” and are concerned about reputational risk.

But Stripe’s seal of approval—and the growing list of Fortune

500 companies exploring USDC—should alter that mindset. The infrastructure is

maturing. The user base is growing. And the demand is real.

The

Bottom Line

Stablecoins are no longer a backend utility for settlements

or crypto exchanges. They’re becoming a frontline feature for acquisition,

retention, and monetization—especially in the retail brokerage space.

As adoption surpasses 100 million wallets and issuers like

Stripe integrate stablecoins into mission-critical applications, there are two

choices that present themselves to the brokers:

1. Wait and watch, or

2. Move early and lead.

Those who embrace this shift will free up quicker growth,

better margins, and richer client relationships.

Those who wait risk falling

behind—not just technologically, but in users’ minds.

“We’re excited to support stablecoins, with near-instant,

near-free global transactions”: this line stood out in Stripe’s 2024 annual letter.

That was not just an product update. It was a signal. One

of the world’s most trusted fintech platforms is throwing its weight behind

stablecoins as default rails for global commerce. And indeed Stripe did it: it acquired stablecoin-focused startup Bridge for $1.1 billion. Another notable deal that has been made to make stablecoin mainstream is the $1.25 billion acquisition of Hidden Road by Ripple.

In parallel, Brian Armstrong, Coinbase CEO, seconded the potential in a recent

tweet on X, calling on U.S. regulators to speed up work on stablecoins. He

noted that more than $150 billion in stablecoins are now circulating worldwide,

acting as a medium of exchange, store of value, and cross-border payment rail.

This transition isn’t hypothetical. It’s already occurring at scale.

Tether recently reported that over 109 million on-chain

wallets hold USDT, with 54 million wallets holding over $0.01. The remaining

stablecoins (like USDC, DAI, and FDUSD) account for another 13.8 million

wallets with significant balances. And stablecoin active wallets were at 22

million by the end of 2024.

— Brian Armstrong (@brian_armstrong) March 31, 2025

One must ask: Why have fewer retail brokerages centered

stablecoins as the core of their offerings? As the potential is vast, its and not only

operational, but a strategic decision.

Strategic Advantage of Adopting Stablecoins

The three key levers where retail brokers have a unique opportunity to leverage

stablecoins are funding speed, possible yield , and

marketing distinction.

1. Instant Stablecoin

Funding: One of the most significant challenges for retail clients is

the inconvenience around funding accounts. Legacy approaches—ACH, wires, credit

cards—take time, come with fees, or are limiting. And stablecoins can make this process near instant.

There will also be the advantage of 24×7, borderless lending at near-zero cost.

Emerging market customers can further bypass local banking

hurdles and top up their accounts with USDC or USDT directly from a

cryptocurrency wallet.

Additionally, local customers will not need to wait hours (or days) for

deposits to clear.

For brokers, this means faster activation, more integrated

user experience, and reduced operational overhead. And, it gives them an

always-on revenue stream—traders don’t need to be bound by banking hours, and

neither do brokers. It will ultimately result in lower conversion costs, higher conversion

rates and potentially quicker revenue generation.

When Stripe is already enabling stablecoin payouts to merchants

and gig workers, retail brokers need to be asking themselves: Why not traders

too?

2. Yield on Idle Stablecoin Balances: With more competitive rates elsewhere in the

globe, customers are yield-sensitive as never before. Leaving money idle in a

0% payout brokerage account no longer makes sense. Stablecoins can create a new value proposition here. One of the offerings by brokers can be enabling traders to earn

interest on USDC balances—without investing in riskier assets.

Brokers

can be compatible with platforms that earn yields or maintain reserves to split

part of the profits with customers. Even a 2–4% APY on idle stablecoin balances

makes the platform more sticky, competitive, and customer-friendly.

It has already been embraced by neobanks and crypto wallets—why not brokerages?

Why it matters: Paying yield on stablecoin balances isn’t a

nicety—it’s getting to table stakes in an economy where consumers are asking

for money to make their money.

3. Marketing Differentiation: The fintech market is saturated. Brokers are differentiating

on fees, UX, access to assets, and learning tools. Stablecoins offer up a new

marketing point of difference that resonates with digitally-native customers.

Imagine launching your next campaign with: “Fund instantly. Trade

everywhere. Get paid while you wait.”

That’s a compelling narrative—especially to young,

crypto-savvy, and international traders who expect seamless experiences and

borderless access. By offering USDC or USDT wallets, instant funding, and

yield, brokers can redefine themselves as innovative, borderless, and

responsive to user needs.

This isn’t about crypto—it’s about user experience.

How Stablecoins Can Change Funding

Let’s look at an example retail brokerage—hypothetical Broker

X.

Now, their clients fund accounts via bank transfer or debit

card. Settlement is 1–2 days. Cash gets 0%. And tickets regarding funding

problems are piling up.

Now imagine Broker X

has stablecoin rails:

• A Brazilian

trader funds their account with USDC directly from a crypto wallet.

• They start

trading right away—no FX conversion, no fees.

• When idle,

their USDC earns 3% APY.

• When they draw out profits, it settles into their wallet in

less than a minute.

That’s not just a technical upgrade. That’s a business advantage—less

churn, higher satisfaction, and more referrals.

Excited to power onchain stablecoin insights for Bridge’s @stablecoin new blog series

Artemis charts track everything from supply and transaction volume (MEV/intra-CEX stripped) to active wallets – across 50+ stablecoins and chains – bringing a clearer view of real usage.

Check… pic.twitter.com/U5UEsPuTma

— Artemis (@artemis) April 7, 2025

What’s Holding Brokers Back?

Too many brokers are still holding back, even with the clear

benefits. Why?

• Regulatory uncertainty: Compliance teams are still

wrestling with how to handle stablecoin flows. This starts to clear up with

more countries implementing regulatory framework around stablecoins.

• Operational integration: Adding stablecoin rails isn’t

plug-and-play (yet).

• Perception: Some still view stablecoins as “crypto

adjacent” and are concerned about reputational risk.

But Stripe’s seal of approval—and the growing list of Fortune

500 companies exploring USDC—should alter that mindset. The infrastructure is

maturing. The user base is growing. And the demand is real.

The

Bottom Line

Stablecoins are no longer a backend utility for settlements

or crypto exchanges. They’re becoming a frontline feature for acquisition,

retention, and monetization—especially in the retail brokerage space.

As adoption surpasses 100 million wallets and issuers like

Stripe integrate stablecoins into mission-critical applications, there are two

choices that present themselves to the brokers:

1. Wait and watch, or

2. Move early and lead.

Those who embrace this shift will free up quicker growth,

better margins, and richer client relationships.

Those who wait risk falling

behind—not just technologically, but in users’ minds.